Integration of Smart Technologies

The integration of smart technologies into the drug infusion-system market is transforming patient care in France. Innovations such as IoT-enabled devices and advanced monitoring systems are enhancing the efficiency and safety of drug delivery. These technologies allow for real-time data collection and analysis, enabling healthcare professionals to make informed decisions quickly. The market for smart infusion systems is expected to grow significantly, with estimates suggesting a value increase to over €1 billion by 2027. This technological evolution not only improves patient outcomes but also streamlines hospital operations, making it a critical driver for the drug infusion-system market. As healthcare facilities increasingly adopt these advanced systems, the overall landscape of drug delivery is likely to evolve, emphasizing precision and reliability.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the drug infusion-system market in France. The French government has been actively promoting healthcare innovation through various funding programs aimed at enhancing medical technologies. These initiatives are designed to support research and development in the drug infusion sector, encouraging companies to innovate and improve their offerings. Recent reports suggest that public funding for healthcare technologies has increased by 15% over the past year, indicating a strong commitment to advancing medical care. This financial support not only fosters innovation but also ensures that healthcare providers have access to the latest drug infusion systems, ultimately benefiting patients and the healthcare system as a whole.

Focus on Cost-Effectiveness in Healthcare

The drug infusion system market in France is increasingly driven by a focus on cost-effectiveness in healthcare delivery. As healthcare costs continue to rise, both providers and patients are seeking solutions that offer better value without compromising quality. Drug infusion systems, particularly those that enhance efficiency and reduce waste, are becoming more attractive in this context. Recent analyses indicate that hospitals can save up to 20% on medication costs by implementing advanced infusion technologies. This emphasis on cost management is likely to propel the adoption of drug infusion systems, as healthcare facilities strive to optimize their budgets while maintaining high standards of patient care. The trend towards value-based care further reinforces this driver, as stakeholders prioritize outcomes and cost efficiency.

Increasing Prevalence of Chronic Diseases

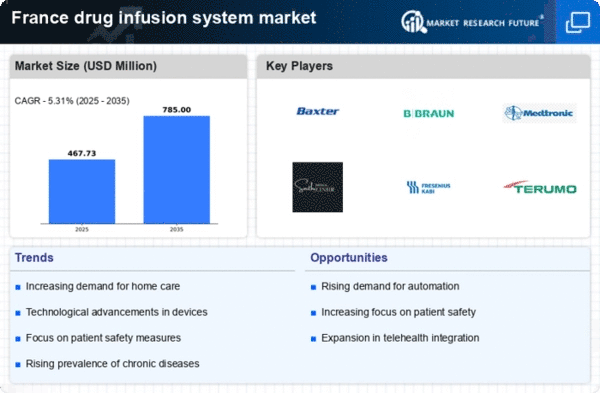

The drug infusion system market in France is significantly influenced by the rising prevalence of chronic diseases. These include diabetes, cancer, and cardiovascular disorders. As these conditions become more common, the demand for effective treatment options, including drug infusion systems, is expected to rise. Recent statistics indicate that chronic diseases account for approximately 70% of all deaths in France, highlighting the urgent need for efficient management solutions. This trend is likely to drive investments in drug infusion technologies, as healthcare providers seek to improve patient outcomes and reduce healthcare costs. The growing focus on personalized medicine further emphasizes the importance of drug infusion systems, as tailored therapies often require precise delivery methods.

Rising Demand for Home Healthcare Solutions

The drug infusion-system market in France is experiencing a notable increase in demand for home healthcare solutions. This trend is driven by an aging population and a growing preference for at-home treatments. As patients seek more comfortable and convenient options, healthcare providers are adapting by integrating drug infusion systems into home care settings. According to recent data, the home healthcare market is projected to grow at a CAGR of approximately 8% over the next five years. This shift not only enhances patient satisfaction but also reduces hospital readmission rates, thereby influencing the drug infusion-system market positively. The increasing prevalence of chronic diseases further fuels this demand, as patients require ongoing treatment that can be effectively managed at home.