Aging Population

France's demographic shift towards an aging population is likely to have profound implications for the critical illness-insurance market. By 2025, it is estimated that over 20% of the French population will be aged 65 and older. This demographic is generally at a higher risk for chronic diseases and critical health conditions, which may drive demand for insurance products that provide coverage for such eventualities. The critical illness insurance market is likely to experience increased uptake as older individuals seek to safeguard their financial stability and ensure access to necessary medical care. This trend indicates a growing market potential as insurers adapt their offerings to meet the needs of an aging clientele.

Rising Healthcare Costs

The increasing costs associated with healthcare in France appear to be a significant driver for the critical illness-insurance market. As medical expenses continue to rise, individuals are becoming more aware of the financial burden that critical illnesses can impose. In 2025, healthcare expenditure in France is projected to reach approximately €300 billion, which represents a growth of around 4% from previous years. This trend suggests that consumers are more inclined to seek financial protection through critical illness insurance to mitigate potential out-of-pocket expenses. The critical illness-insurance market is likely to benefit from this heightened awareness, as individuals prioritize securing their financial future against unforeseen health challenges.

Increased Focus on Preventive Healthcare

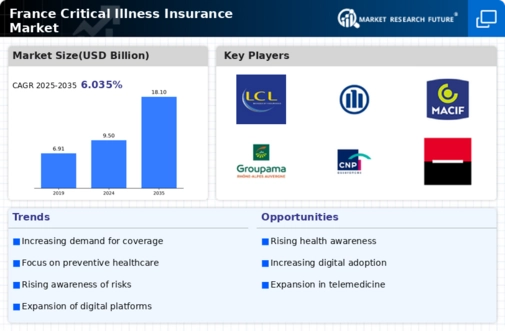

The shift towards preventive healthcare in France is emerging as a notable driver for the critical illness-insurance market. As public health campaigns promote early detection and lifestyle changes, individuals are becoming more proactive about their health. This trend is reflected in the rising participation in health screenings and wellness programs, which could lead to earlier diagnoses of critical illnesses. Consequently, the critical illness-insurance market may experience growth as consumers recognize the importance of having coverage that complements their preventive health measures. Insurers may also respond by developing products that incentivize healthy behaviors, further enhancing market appeal.

Changing Attitudes Towards Insurance Products

The evolving attitudes of consumers towards insurance products in France are shaping the landscape of the critical illness-insurance market. Younger generations, in particular, are increasingly viewing insurance as a necessary component of financial planning rather than an optional expense. This shift in perception is likely to drive demand for critical illness insurance as individuals seek to protect themselves against unforeseen health events. Market data suggests that approximately 30% of millennials in France are considering purchasing critical illness insurance within the next year. This trend indicates a potential growth opportunity for insurers to engage with younger consumers and develop products that resonate with their values and financial goals.

Technological Advancements in Health Monitoring

Technological advancements in health monitoring and telemedicine are likely to influence the critical illness-insurance market positively. With the proliferation of wearable health devices and mobile health applications, individuals can now track their health metrics more effectively. This increased access to health data may lead to a greater awareness of personal health risks, prompting consumers to consider critical illness insurance as a safeguard. In 2025, it is anticipated that the telehealth market in France will exceed €1 billion, indicating a growing acceptance of technology in healthcare. The critical illness-insurance market could leverage these advancements to offer tailored products that align with consumers' health management strategies.