France Core Banking Solutions Market Summary

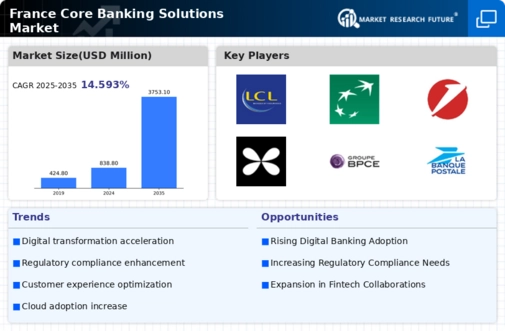

The France Core Banking Solutions Market is poised for substantial growth, projected to reach 3753.1 USD Million by 2035.

Key Market Trends & Highlights

France Core Banking Solutions Market Key Trends and Highlights

- The market valuation is expected to grow from 838.8 USD Million in 2024 to 3753.1 USD Million by 2035.

- A compound annual growth rate (CAGR) of 14.59 percent is anticipated for the period from 2025 to 2035.

- The increasing demand for digital banking solutions is likely to drive market expansion in the coming years.

- Growing adoption of cloud computing due to the need for enhanced operational efficiency is a major market driver.

Market Size & Forecast

| 2024 Market Size | 838.8 (USD Million) |

| 2035 Market Size | 3753.1 (USD Million) |

| CAGR (2025-2035) | 14.59% |

Major Players

LCL, Société Générale, Crédit Agricole, HSBC France, Barclays France, BNP Paribas, BPCE, Deutsche Bank France, ING France, UniCredit, Credit Mutuel, Santander Bank France, CIC, Natixis, La Banque Postale