Increased Focus on Financial Inclusion

The France buy now pay later market is increasingly focusing on financial inclusion, aiming to provide accessible credit options to a broader range of consumers. This shift is particularly relevant in a country where traditional credit access can be limited for certain demographics, such as younger individuals or those with less established credit histories. By offering buy now pay later services, providers are enabling these consumers to make purchases without the burden of upfront costs. Recent initiatives by various companies have highlighted the importance of responsible lending practices, ensuring that consumers are not overburdened by debt. This emphasis on financial inclusion is likely to drive growth in the industry, as more consumers recognize the benefits of flexible payment solutions.

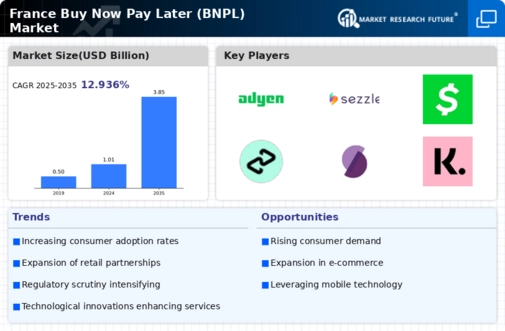

Expansion of E-commerce and Digital Retail

The France buy now pay later market is significantly influenced by the rapid expansion of e-commerce and digital retail platforms. As online shopping becomes increasingly prevalent, consumers are seeking payment solutions that enhance their purchasing experience. In 2025, e-commerce sales in France reached approximately 130 billion euros, with a substantial portion of these transactions being facilitated through buy now pay later options. This integration not only simplifies the checkout process but also encourages higher average order values, as consumers feel more comfortable making larger purchases when they can spread the cost over time. Consequently, the growth of e-commerce is expected to further propel the adoption of buy now pay later services, creating a symbiotic relationship between the two sectors.

Regulatory Environment and Consumer Protection

The regulatory environment surrounding the France buy now pay later market is evolving, with increasing emphasis on consumer protection. Recent legislative measures aim to ensure transparency in lending practices and safeguard consumers from potential pitfalls associated with installment payment options. For example, regulations may require providers to disclose all fees and terms associated with buy now pay later services, fostering a more informed consumer base. This regulatory scrutiny is likely to enhance consumer confidence in these payment options, potentially leading to increased adoption. As the industry adapts to these regulatory changes, it may also encourage more responsible lending practices, ultimately benefiting both consumers and providers in the long term.

Technological Advancements in Payment Solutions

Technological advancements are playing a crucial role in shaping the France buy now pay later market. Innovations in mobile payment technologies, artificial intelligence, and data analytics are enabling providers to offer more personalized and efficient services. For instance, the use of AI algorithms allows companies to assess creditworthiness in real-time, thereby streamlining the approval process for consumers. This technological evolution not only enhances user experience but also mitigates risks for providers, as they can make informed lending decisions. As these technologies continue to evolve, they are likely to attract more consumers to buy now pay later options, further solidifying the industry's position within the broader financial landscape in France.

Rising Consumer Demand for Flexible Payment Options

The France buy now pay later market is experiencing a notable surge in consumer demand for flexible payment solutions. This trend is particularly pronounced among younger demographics, who increasingly prefer to manage their finances through installment payments rather than traditional credit options. Recent data indicates that approximately 30% of French consumers have utilized buy now pay later services in the past year, reflecting a shift in purchasing behavior. This growing preference for flexibility is likely to drive further innovation and competition within the industry, as providers seek to cater to the evolving needs of consumers. Additionally, the convenience of these payment options aligns with the fast-paced lifestyle of many French consumers, suggesting that the demand for buy now pay later services will continue to expand in the coming years.