Focus on Sustainable Sourcing

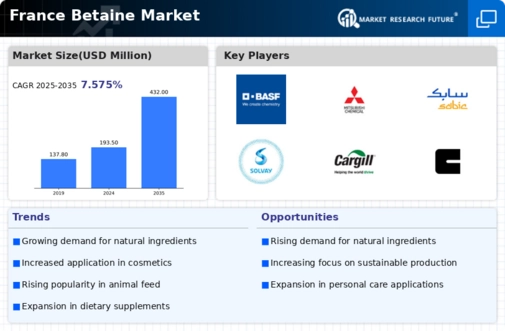

Sustainability is becoming a pivotal driver in the betaine market, particularly in France. There is a growing emphasis on sustainable sourcing of raw materials used in the production of betaine. Consumers and businesses alike are increasingly prioritizing environmentally friendly practices, which is influencing purchasing decisions. In 2025, it is projected that the demand for sustainably sourced betaine could increase by 18%, as companies strive to meet consumer expectations for ethical and responsible production. This trend is prompting manufacturers to explore alternative sources and methods that minimize environmental impact. As sustainability becomes a core value for many brands, the betaine market is likely to evolve, with a focus on transparency and eco-friendly practices that resonate with the values of modern consumers.

Growth in Personal Care Products

The betaine market is witnessing a notable expansion in the personal care sector in France. Betaine is increasingly utilized in cosmetics and personal care products due to its moisturizing properties and skin compatibility. The market for personal care products containing betaine is expected to grow by around 10% annually, reflecting a shift towards natural and gentle ingredients. Consumers are becoming more aware of the benefits of using products with betaine, which is perceived as a safer alternative to synthetic compounds. This trend aligns with the broader movement towards clean beauty, where the demand for transparency and sustainability is paramount. Consequently, manufacturers are likely to invest in research and development to create innovative formulations that leverage the benefits of betaine, thereby propelling the growth of the betaine market in this sector.

Rising Demand in Dietary Supplements

The betaine market is significantly influenced by the rising demand for dietary supplements in France. As health consciousness among consumers increases, the popularity of betaine as a dietary supplement is on the rise. In 2025, the market for betaine-based supplements is projected to grow by approximately 12%, driven by its potential benefits in enhancing athletic performance and supporting liver health. This trend is further supported by a growing body of research suggesting that betaine supplementation may improve muscle strength and endurance. The increasing prevalence of lifestyle-related health issues has prompted consumers to seek out natural supplements, positioning betaine as a favorable option. As a result, the betaine market is likely to see a surge in product offerings tailored to meet the needs of health-conscious individuals.

Increasing Application in Animal Feed

The betaine market in France is experiencing growth due to its increasing application in animal feed. Betaine is recognized for its ability to enhance feed efficiency and improve the overall health of livestock. In 2025, the demand for betaine in animal nutrition is projected to rise by approximately 15%, driven by the need for sustainable and cost-effective feed solutions. This trend is particularly relevant as the livestock industry seeks to optimize production while adhering to stringent regulations. The incorporation of betaine in animal feed not only supports growth but also enhances the quality of meat and dairy products, thereby benefiting the entire supply chain. As a result, the betaine market is likely to see a significant uptick in investment and innovation aimed at improving formulations for various animal species.

Technological Advancements in Production

Technological advancements in the production of betaine are playing a crucial role in shaping the betaine market in France. Innovations in extraction and synthesis methods are leading to more efficient and cost-effective production processes. In 2025, it is anticipated that these advancements could reduce production costs by up to 20%, making betaine more accessible to various industries. Furthermore, improved production techniques are likely to enhance the purity and quality of betaine, which is essential for its application in food, feed, and personal care products. As manufacturers adopt these technologies, the betaine market is expected to benefit from increased supply and a broader range of applications, ultimately driving growth and competitiveness in the market.