Rising Demand for Energy Security

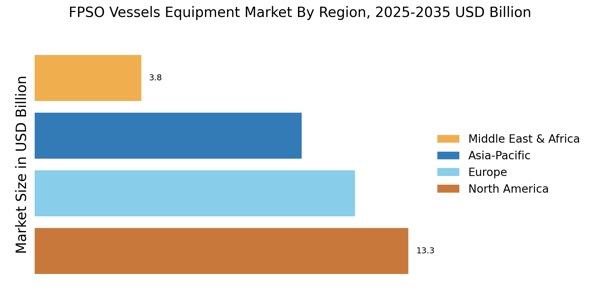

Energy security remains a critical concern for many nations, leading to increased investments in the FPSO Vessels Equipment Market. Countries are diversifying their energy sources and investing in offshore oil and gas production to reduce dependency on imports. This trend is particularly evident in regions with significant offshore reserves, where FPSOs are deployed to ensure a stable energy supply. The FPSO Vessels Equipment Market is likely to benefit from this shift, as operators seek reliable and efficient solutions for energy extraction. Additionally, the growing emphasis on energy independence is prompting governments to support offshore projects, further driving the demand for FPSO vessels and their equipment. As a result, the market is expected to witness substantial growth in the coming years.

Technological Innovations in FPSO Design

Technological innovations are reshaping the FPSO Vessels Equipment Market, with advancements in design and engineering enhancing operational efficiency. Modern FPSOs are equipped with state-of-the-art technology that improves safety, reduces environmental impact, and increases production capacity. Innovations such as dynamic positioning systems and advanced mooring solutions are becoming standard in new FPSO designs. These developments not only optimize the performance of FPSOs but also attract investment from operators looking for cutting-edge solutions. The FPSO Vessels Equipment Market is likely to see a rise in demand for these technologically advanced vessels, as they offer improved reliability and lower operational costs. As the industry continues to evolve, the integration of new technologies will play a pivotal role in shaping the future of FPSO operations.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are becoming increasingly common in the FPSO Vessels Equipment Market, as companies seek to leverage each other's strengths. These alliances often involve technology sharing, joint ventures, and co-development of new FPSO projects. By collaborating, companies can reduce costs, share risks, and enhance their competitive edge in the market. This trend is particularly relevant in the context of complex offshore projects that require diverse expertise and resources. The FPSO Vessels Equipment Market is likely to see a rise in such partnerships, as firms aim to optimize their operations and expand their market presence. Additionally, these collaborations can lead to innovative solutions that address the evolving challenges faced by the industry, further driving growth in the FPSO Vessels Equipment Market.

Increasing Offshore Oil and Gas Exploration

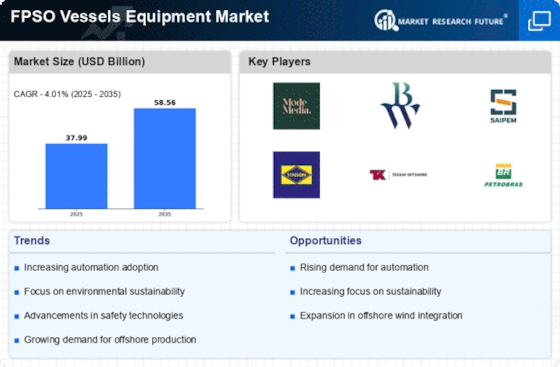

The FPSO Vessels Equipment Market is experiencing a surge in demand due to the increasing exploration activities in offshore oil and gas fields. As energy companies seek to tap into untapped reserves, the need for Floating Production Storage and Offloading (FPSO) vessels becomes paramount. According to recent data, offshore oil production is projected to grow, with FPSOs playing a crucial role in this expansion. The ability of FPSOs to operate in deepwater and remote locations makes them an attractive option for operators. This trend is likely to drive investments in FPSO vessels and their associated equipment, thereby bolstering the FPSO Vessels Equipment Market. Furthermore, advancements in technology are enhancing the efficiency and safety of these vessels, further encouraging their adoption in offshore projects.

Growing Focus on Environmental Sustainability

The FPSO Vessels Equipment Market is increasingly influenced by the growing focus on environmental sustainability. Operators are under pressure to minimize their ecological footprint, leading to the adoption of greener technologies and practices in FPSO operations. This includes the implementation of systems that reduce emissions and enhance waste management. Regulatory bodies are also tightening environmental standards, prompting companies to invest in equipment that meets these requirements. The FPSO Vessels Equipment Market is likely to benefit from this trend, as operators seek to comply with regulations while maintaining operational efficiency. Furthermore, the integration of renewable energy sources into FPSO designs is becoming more prevalent, indicating a shift towards sustainable practices in offshore oil and gas production.