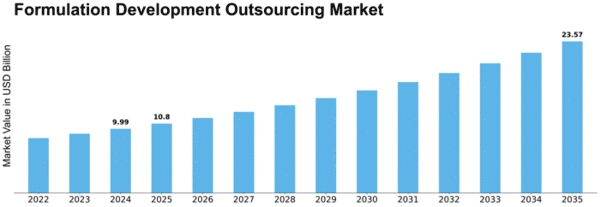

Formulation Development Outsourcing Size

Formulation Development Outsourcing Market Growth Projections and Opportunities

The marketplace for hemodynamic monitoring systems is influenced by the rising predominance of cardiovascular illnesses worldwide. With a rising number of patients experiencing conditions, for example, cardiovascular breakdown and hypertension, there is a developing interest for cutting edge monitoring systems to survey and oversee hemodynamic boundaries. The section shift towards a maturing populace contributes essentially to the market elements. Elderly people are more susceptible to cardiovascular diseases, necessitating continuous monitoring of hemodynamic parameters. As humanity gets older, there is a greater need for hemodynamic monitoring devices in various medical care settings, such as emergency clinics and institutions. Persistent illnesses, such as obesity and Type 2 diabetes, are on becoming more prevalent throughout the globe. These circumstances frequently lead to cardiovascular inconveniences, further filling the interest for hemodynamic monitoring systems. Consistent monitoring of hemodynamic boundaries is critical in overseeing and forestalling complexities related with persistent illnesses. Careful interventions, particularly cardiovascular and major vascular medical procedures, require exact hemodynamic monitoring for ideal patient results. The developing number of surgeries overall adds to the interest for cutting edge monitoring systems that give constant information to direct clinical experts in pursuing informed choices during medical procedures. There is an elevated accentuation on persistent wellbeing in medical services settings, driving the reception of hemodynamic monitoring systems. These systems help in early recognition of hemodynamic unsteadiness, permitting medical services suppliers to mediate quickly and forestall hostile occasions. The rising mindfulness about the significance of patient wellbeing adds to the market development. Interests in medical care framework, especially in arising economies, emphatically influence the hemodynamic monitoring systems market. The extension of medical care offices and the fuse of cutting-edge clinical advances set out open doors for the reception of hemodynamic monitoring systems in both established and developing districts. The combination of artificial intelligence in hemodynamic monitoring systems upgrades their abilities in information examination and translation. Computer based intelligence driven calculations give prescient examination, helping with early identification of irregularities and empowering proactive patient administration. The joining of artificial intelligence advancements adds to the market's strength and interest.

Leave a Comment