Focus on Speed to Market

The focus on speed to market is a significant driver in the Global Formulation Development Outsourcing Market Industry. In a highly competitive pharmaceutical landscape, companies are under pressure to expedite the development and launch of new products. Outsourcing formulation development allows firms to leverage the capabilities of specialized providers, thereby accelerating the overall development timeline. This urgency is reflected in the market's projected growth, with an expected increase to 9.97 USD Billion in 2024. As companies prioritize rapid product development, the outsourcing of formulation services is likely to become an increasingly attractive option.

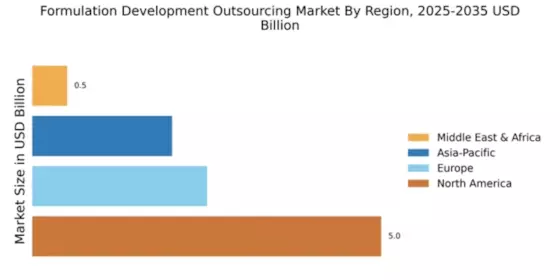

Market Growth Projections

The Global Formulation Development Outsourcing Market Industry is poised for substantial growth, with projections indicating a rise from 9.97 USD Billion in 2024 to 23.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.14% from 2026 to 2035. Such figures reflect the increasing reliance of pharmaceutical companies on outsourcing to enhance efficiency, reduce costs, and meet regulatory demands. The market's expansion is indicative of broader trends in the pharmaceutical sector, where innovation and specialization are becoming essential for success.

Rising Demand for Biologics

The Global Formulation Development Outsourcing Market Industry experiences a notable increase in demand for biologics, which are complex molecules derived from living organisms. This trend is driven by the growing prevalence of chronic diseases and the need for innovative therapies. As pharmaceutical companies focus on developing biologics, outsourcing formulation development becomes a strategic choice to leverage specialized expertise and reduce time to market. The market for biologics is projected to grow significantly, contributing to the overall growth of the Global Formulation Development Outsourcing Market, which is expected to reach 9.97 USD Billion in 2024 and 23.6 USD Billion by 2035.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the Global Formulation Development Outsourcing Market Industry. By outsourcing formulation development, companies can significantly reduce operational costs associated with in-house development. This approach allows organizations to allocate resources more effectively, focusing on core competencies while leveraging the expertise of specialized service providers. As the market evolves, the potential for cost savings becomes increasingly attractive, particularly for small and medium-sized enterprises. The anticipated compound annual growth rate of 8.14% from 2026 to 2035 underscores the financial advantages that outsourcing can offer, further propelling the growth of the Global Formulation Development Outsourcing Market.

Regulatory Compliance and Quality Assurance

Regulatory compliance and quality assurance are paramount in the Global Formulation Development Outsourcing Market Industry. As regulatory bodies impose stringent guidelines on drug development, companies must ensure that their formulations meet these standards. Outsourcing formulation development to experienced service providers can facilitate adherence to regulatory requirements, thereby mitigating risks associated with non-compliance. This necessity for quality assurance drives pharmaceutical companies to seek external expertise, fostering growth in the outsourcing market. The increasing complexity of regulations further emphasizes the importance of outsourcing, as companies strive to maintain high-quality standards in their formulations.

Technological Advancements in Drug Development

Technological advancements play a pivotal role in shaping the Global Formulation Development Outsourcing Market Industry. Innovations in drug formulation technologies, such as nanotechnology and 3D printing, enhance the efficiency and effectiveness of drug development processes. These advancements enable companies to create more effective formulations with improved bioavailability and stability. As pharmaceutical firms increasingly adopt these technologies, the demand for specialized formulation development services is likely to rise. This trend is expected to contribute to the market's growth trajectory, with projections indicating a rise to 23.6 USD Billion by 2035, reflecting the industry's adaptation to cutting-edge technologies.