Rising Demand in Agriculture

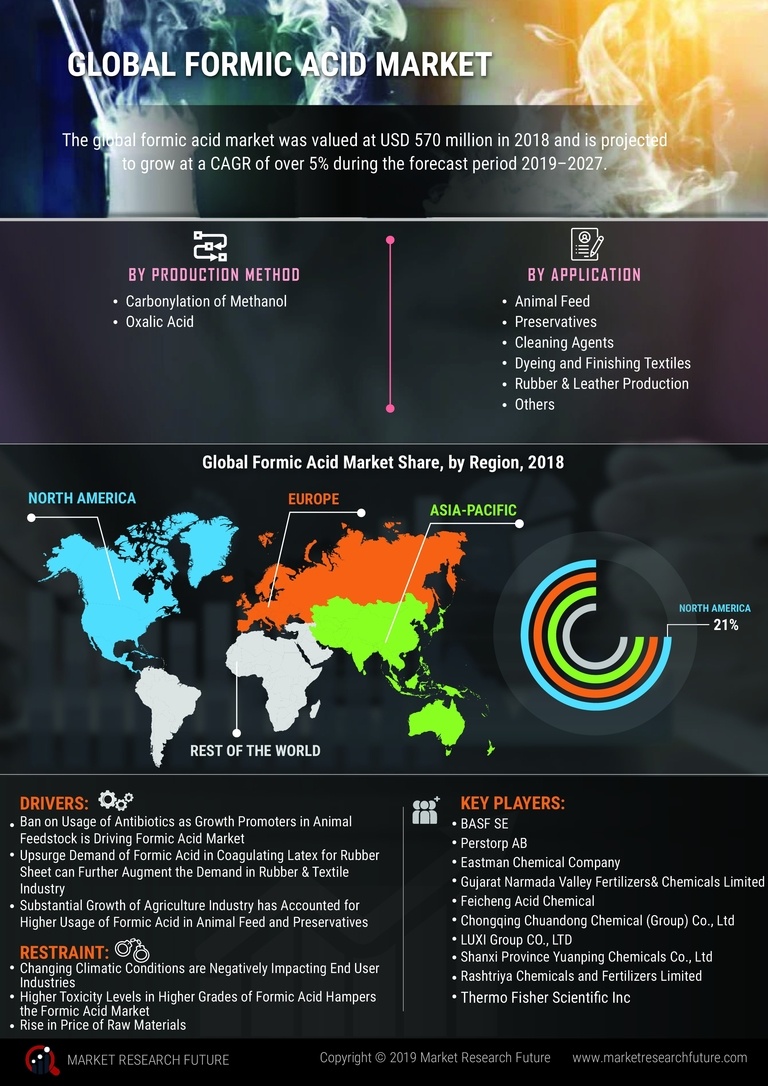

The Formic Acid Market is experiencing a notable increase in demand due to its applications in agriculture, particularly as a preservative and feed additive. Formic acid is utilized in silage production, enhancing the nutritional value of animal feed. The market for agricultural chemicals, including formic acid, is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is driven by the need for sustainable farming practices and the rising global population, which necessitates increased food production. As farmers seek effective solutions to improve crop yields and livestock health, the Formic Acid Market is likely to benefit significantly from this trend.

Growth in the Textile Industry

The textile industry is a significant contributor to the demand for formic acid, which is used in dyeing and finishing processes. As the textile market expands, particularly in developing regions, the Formic Acid Market is expected to see substantial growth. The increasing consumer preference for high-quality textiles and sustainable production methods is driving manufacturers to seek effective chemical solutions. The textile chemicals market is projected to grow at a rate of around 4% annually, which bodes well for the formic acid sector. This growth indicates a promising future for the Formic Acid Market as it aligns with the evolving needs of the textile sector.

Industrial Applications and Versatility

The versatility of formic acid in various industrial applications is a key driver for the Formic Acid Market. It is widely used in the production of leather, textiles, and rubber, as well as in the manufacturing of chemicals and pharmaceuticals. The increasing demand for leather goods and textiles, particularly in emerging economies, is expected to bolster the market. Additionally, formic acid serves as a reducing agent in chemical reactions, further expanding its utility across different sectors. The industrial chemicals market is anticipated to grow, and with it, the Formic Acid Market is poised to capitalize on this expanding demand.

Environmental Regulations and Compliance

The Formic Acid Market is influenced by stringent environmental regulations aimed at reducing harmful emissions and promoting safer chemical alternatives. Governments are increasingly enforcing regulations that encourage the use of less toxic substances in various applications. Formic acid, being a relatively eco-friendly option, is gaining traction as industries seek to comply with these regulations. The market for green chemicals is projected to grow, and formic acid's profile as a sustainable chemical solution positions it favorably. This regulatory landscape is likely to drive innovation and adoption within the Formic Acid Market.

Emerging Markets and Economic Development

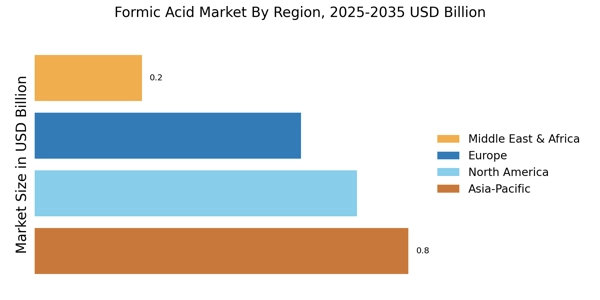

Emerging markets are becoming increasingly important for the Formic Acid Market, as economic development leads to higher industrial activity and demand for chemicals. Countries in Asia and Latin America are witnessing rapid industrialization, which is driving the need for various chemical products, including formic acid. The growth of industries such as agriculture, textiles, and pharmaceuticals in these regions is expected to create new opportunities for market players. As these economies continue to develop, the Formic Acid Market is likely to experience a surge in demand, reflecting the broader trends of economic growth and industrial expansion.