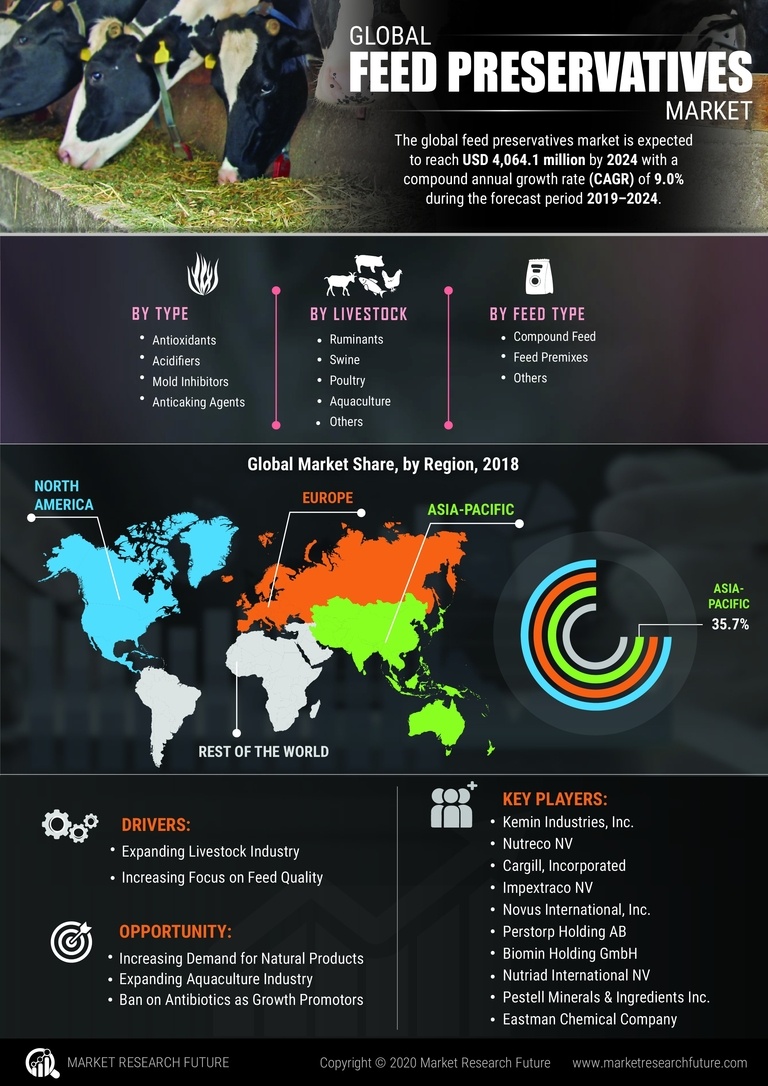

Increasing Livestock Production

The rise in livestock production is a significant driver for the Feed Preservatives Market. As countries strive to meet the growing demand for meat, dairy, and eggs, the need for effective feed preservation becomes paramount. The livestock sector is projected to expand, with estimates indicating a substantial increase in production levels over the next decade. This growth necessitates the use of preservatives to ensure that feed remains fresh and free from spoilage, thereby supporting animal health and productivity. Moreover, the Feed Preservatives Market is likely to benefit from the trend of intensifying livestock farming practices, which require reliable preservation methods to maintain feed quality. As producers adapt to these demands, the market for feed preservatives is expected to flourish.

Focus on Feed Quality and Safety

The emphasis on feed quality and safety is a pivotal driver for the Feed Preservatives Market. With increasing awareness regarding food safety and the potential risks associated with contaminated feed, livestock producers are prioritizing the use of preservatives to mitigate these risks. Regulatory bodies are also imposing stricter guidelines on feed safety, compelling manufacturers to adopt preservatives that ensure compliance. The market for feed preservatives is projected to grow as producers recognize the necessity of maintaining high-quality feed to safeguard animal health and, by extension, public health. This focus on safety not only enhances the reputation of producers but also aligns with consumer expectations for safe and healthy food products. As a result, the Feed Preservatives Market is likely to see sustained growth driven by these quality and safety concerns.

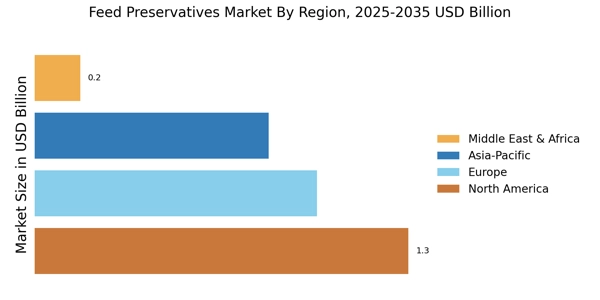

Rising Demand for Animal Protein

The increasing The Feed Preservatives Industry. As consumers become more health-conscious, the need for high-quality meat and dairy products intensifies. This trend is reflected in the projected growth of the livestock sector, which is expected to expand significantly in the coming years. Consequently, feed preservatives play a crucial role in maintaining the quality and safety of animal feed, thereby ensuring optimal livestock health and productivity. The Feed Preservatives Market is likely to benefit from this heightened demand, as producers seek effective solutions to enhance feed shelf life and prevent spoilage. Furthermore, the integration of preservatives in feed formulations is anticipated to become a standard practice, further solidifying their importance in the industry.

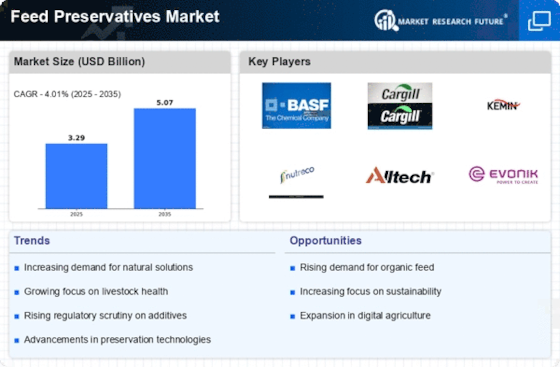

Consumer Preference for Sustainable Practices

Consumer preference for sustainable agricultural practices is increasingly influencing the Feed Preservatives Market. As awareness of environmental issues grows, consumers are demanding products that are produced sustainably, including animal feed. This shift is prompting livestock producers to seek out feed preservatives that align with sustainable practices, such as natural and organic options. The market is responding to this trend by developing preservatives that not only enhance feed quality but also minimize environmental impact. The integration of sustainable practices in feed production is likely to drive innovation within the Feed Preservatives Market, as companies strive to meet consumer expectations. This alignment with sustainability could potentially enhance brand loyalty and market share for producers who prioritize eco-friendly solutions.

Technological Innovations in Preservation Techniques

Technological advancements in preservation techniques are reshaping the Feed Preservatives Market. Innovations such as the development of natural preservatives and improved application methods are enhancing the efficacy of feed preservation. These advancements not only extend the shelf life of feed but also improve its nutritional value, which is increasingly important to livestock producers. The market is witnessing a shift towards more sophisticated preservation technologies, which are expected to drive growth in the coming years. For instance, the introduction of encapsulation techniques allows for the targeted release of preservatives, optimizing their effectiveness. As producers seek to enhance feed quality while minimizing waste, the Feed Preservatives Market is likely to experience a surge in demand for these innovative solutions.