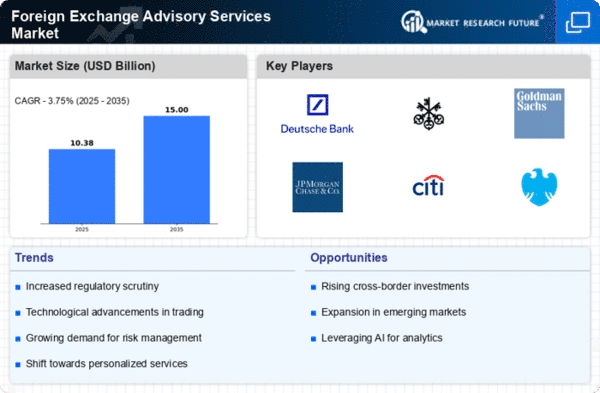

The Foreign Exchange Advisory Services Market is characterized by a dynamic competitive landscape, driven by factors such as globalization, technological advancements, and the increasing complexity of currency markets. Major players like Deutsche Bank (DE), Goldman Sachs (US), and HSBC (GB) are strategically positioned to leverage their extensive networks and technological capabilities. Deutsche Bank (DE) focuses on enhancing its digital platforms to provide real-time advisory services, while Goldman Sachs (US) emphasizes innovation through AI-driven analytics to optimize trading strategies. HSBC (GB) is actively pursuing regional expansion in Asia, aiming to capture emerging market opportunities. Collectively, these strategies contribute to a competitive environment that is increasingly reliant on technology and customer-centric solutions.Key business tactics within the market include localized service offerings and supply chain optimization, which are essential for meeting the diverse needs of clients across different regions. The market structure appears moderately fragmented, with a mix of large multinational banks and specialized advisory firms. The influence of key players is substantial, as they set industry standards and drive innovation, thereby shaping the overall market dynamics.

In November JPMorgan Chase (US) announced a strategic partnership with a leading fintech firm to enhance its foreign exchange advisory capabilities. This collaboration aims to integrate advanced analytics and machine learning into their advisory services, potentially improving client outcomes and operational efficiency. Such a move underscores JPMorgan's commitment to staying at the forefront of technological advancements in the foreign exchange sector.

In October Citigroup (US) launched a new suite of digital tools designed to streamline currency risk management for corporate clients. This initiative reflects Citigroup's focus on digital transformation and its intent to provide more agile and responsive services. By equipping clients with innovative tools, Citigroup positions itself as a leader in addressing the evolving needs of businesses in a complex currency landscape.

In September Barclays (GB) expanded its foreign exchange advisory team in Asia, aiming to enhance its service offerings in this rapidly growing market. This strategic move indicates Barclays' recognition of the importance of regional expertise and its commitment to capturing market share in Asia's burgeoning economies. By bolstering its local presence, Barclays seeks to provide tailored solutions that resonate with clients in the region.

As of December current trends in the Foreign Exchange Advisory Services Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, as firms collaborate to enhance their service offerings and technological capabilities. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that firms that prioritize technological advancements and customer-centric solutions will be better positioned to thrive in the future.