Market Trends

Key Emerging Trends in the Food and Beverages Color Fixing Agents Market

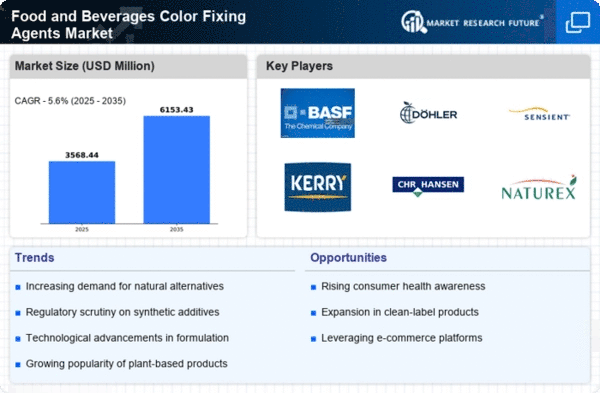

Significant trends have been witnessed in Food and Beverages Color Fixing Agents Market which is an important sector within the food industry driven by consumer preference, regulatory pressures, and technological improvements. One of these major trends is increasingly high demand for natural color fixing agents. Consumers now prefer foods and drinks without many artificial additives because they are focusing more on clean label products made out of natural ingredients. This has led manufacturers to turn towards using natural color fixing agents derived from fruits, vegetables other plant sources that help make their food look like something fresh coming from nature itself.

Another trend worth mentioning is its focus on stability plus shelf-life extension. Advanced color fixing agents are used by producers of meals and drinks so as increase stability of natural colors in order to prolong shelf lives for their goods. A case can be made particularly when considering global supply chains where products must maintain their original coloring during transportation or storage processions along them till final consumers thereby necessitating the employment of efficient color fixing agents capable of tackling fading or other related color losses.

Also, the market is adapting to cater for increased need for personalized and customized products. Through such color-fixing agents, manufacturers are able to customize their products in accordance with specific consumer demands who want unique experiences in food and beverage industry. These include making various shades appealing to different customers as they strive to keep up with competitors while dealing with food safety challenges.

Leave a Comment