Regulatory Support for Opioid Use

The regulatory landscape surrounding opioid use, including morphine, is evolving to support its therapeutic applications. Recent legislative measures have aimed to balance the need for effective osteoarthritis pain management with the imperative to curb opioid misuse. This regulatory support is crucial for the Morphine Market, as it may facilitate easier access to morphine for patients in need. For instance, some regions have implemented streamlined prescription processes for chronic pain patients, which could lead to an uptick in morphine prescriptions. Moreover, educational initiatives aimed at healthcare providers about the responsible use of opioids may further enhance the acceptance of morphine as a viable treatment option. As regulations become more favorable, the Morphine Market is likely to experience growth driven by increased accessibility and responsible prescribing practices.

Rising Awareness of Palliative Care

The growing recognition of palliative care as an essential component of healthcare is influencing the Morphine Market. Palliative care focuses on providing relief from the symptoms and stress of serious illnesses, with pain management being a critical aspect. Morphine Market is frequently utilized in palliative care settings to alleviate severe pain, particularly in terminally ill patients. As awareness of palliative care increases, healthcare providers are more likely to incorporate morphine into treatment plans for patients requiring symptom management. This trend is supported by the increasing number of palliative care programs and initiatives aimed at improving patient comfort. Consequently, the Morphine Market may see a rise in demand as more patients benefit from comprehensive palliative care approaches that include effective pain relief.

Increasing Incidence of Chronic Pain

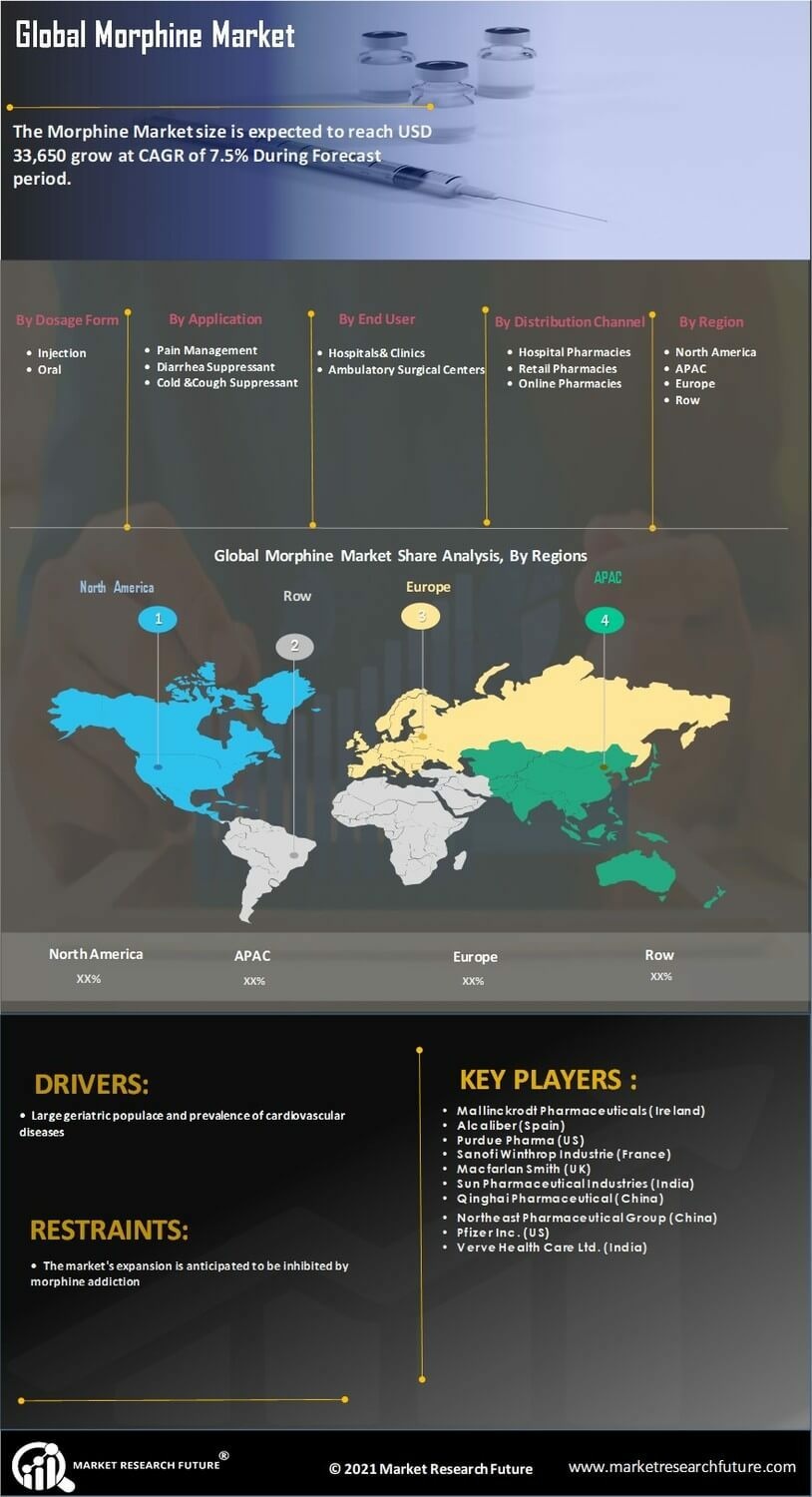

The rising prevalence of chronic pain conditions, such as arthritis and neuropathic pain, is a primary driver of the Morphine Market. According to recent estimates, nearly 20% of adults experience chronic pain, which necessitates effective pain management solutions. Morphine Market, being a potent opioid analgesic, is often prescribed for severe pain relief. This growing patient population is likely to bolster the demand for morphine, as healthcare providers seek effective treatments to enhance patient quality of life. Furthermore, the aging population, which is more susceptible to chronic pain, contributes to this trend. As the number of individuals requiring pain management continues to rise, the Morphine Market is expected to expand significantly, reflecting the urgent need for effective analgesics.

Advancements in Pain Management Protocols

The evolution of pain management protocols is reshaping the Morphine Market. Healthcare professionals are increasingly adopting multimodal approaches to pain management, which often include the use of morphine for severe cases. Recent studies indicate that combining morphine with non-opioid analgesics can enhance pain relief while minimizing side effects. This trend suggests a shift towards more personalized pain management strategies, which may lead to increased morphine prescriptions. Additionally, the integration of morphine into comprehensive pain management plans is likely to improve patient outcomes, further driving demand. As healthcare systems continue to refine their pain management protocols, the Morphine Market stands to benefit from these advancements, potentially leading to a more significant market presence.

Emerging Markets and Healthcare Infrastructure Development

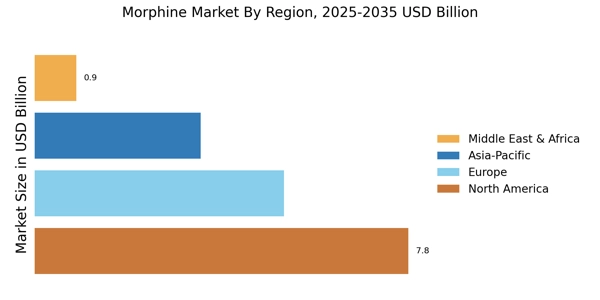

The development of healthcare infrastructure in emerging markets is poised to impact the Morphine Market positively. As these regions enhance their healthcare systems, the availability of essential medications, including morphine, is expected to improve. Recent reports indicate that countries with developing healthcare infrastructures are increasingly recognizing the importance of pain management, leading to a rise in morphine prescriptions. Furthermore, initiatives aimed at training healthcare professionals in pain management practices are likely to foster a more favorable environment for morphine use. As access to morphine becomes more widespread in these markets, the Morphine Market could experience substantial growth, driven by the increasing demand for effective pain relief solutions in regions previously underserved.