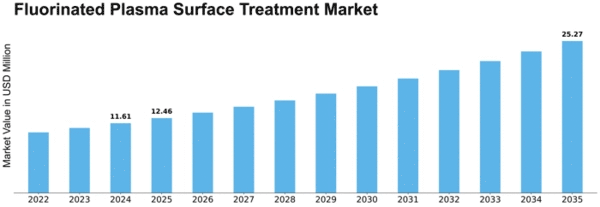

Fluorinated Plasma Surface Treatment Size

Fluorinated Plasma Surface Treatment Market Growth Projections and Opportunities

The Fluorinated Plasma Surface Treatment market is feeded by several market factors that are responsible for the market dynamics driving force. Another feature is the increasing demand of leading edge surface treatment technology used by different industries. At the manufacturing stage, the Fluorinated Plasma Surface Treatment has emerged as a preferred choice for the enhancement of materials’ functionality and life cycle on account of its high efficiency in modifying surface properties. It is predicted that the market for fluorinated plasma surface treatment will grow with the CAGR of about 13.5% and reach $3071 M by year 2025.

Next, development of technologies is another market-driving factor as inventions of plasma treatment techniques supply most current precise and effective solutions. These innovations not only increase the overall efficiency of the treatment but also provide new grounds for more applications beyond the confines of the healthcare industry. With the process of research and development, there may be more advanced and precise fluorinated plumas surface treatments. This in return may create a market with specialized and sophisticated products.

Environmental issues and regulatory demands are among the other factors that drive the growth of the Fluorinated plasma surgery market. In terms of the environmentally friendly nature of the technology that is coupled with its minimum use of chemicals and low environmental impact; it correspondingly fits well with the developing approach toward sustainable practices. Regulatory bodies are getting more supportive of the use of eco-friendly surface treatment methods, which helps to boost market demand as manufacturers indicate their readiness to implement these standards.

Market dynamics would be, to some extent governed by the economic ecosystem with its overall conditions exerting an impact on fluorinated plasma surface treatment. Industries, including automotive, aerospace and electronics, that undertake surface treatment procedures extensively, set the stage for the market development. The economic trends which include the investment into manufacture of industries can drive or slow the demand for fluorinated plasma surface treatment according to the specific demand of the targeted industries.

Global market factors are greatly affected by globalization in the market environment of Fluorinated Plasma Surface Treatment. As businesses enlarge their domain of work around the world, the need for uniform and excellent surface treatment solutions will grow considerably. The requirement of uniformity of the surface characteristics in multiple areas makes the fluorinated plasma techniques of treating surfaces preferred in a global level.

Competitive factors are becoming key to grasp the essence of fluorinated plasma surface treatment market. Market share and strategies of key players are significant for making the market dynamics dynamic. New product developments, collaborations, and mergers & acquisitions of industry players determine the overall direction of the market. This creates a competition that sets the pace for the industry.

Leave a Comment