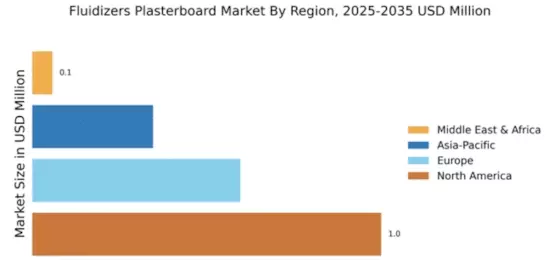

North America : Market Leader in Fluidizers

North America is poised to maintain its leadership in the Fluidizers Plasterboard Market, holding a significant market share of 1.04 billion. The region's growth is driven by robust construction activities, increasing demand for lightweight building materials, and stringent building regulations promoting energy efficiency. The adoption of innovative technologies and sustainable practices further fuels market expansion, making it a key player in the global landscape. The United States stands out as the leading country in this region, with major players like USG Corporation, CertainTeed, and Armstrong World Industries dominating the market. The competitive landscape is characterized by continuous product innovation and strategic partnerships among key players. This dynamic environment is expected to enhance market growth, ensuring North America's continued prominence in the Fluidizers Plasterboard sector.

Europe : Emerging Market Dynamics

Europe is witnessing a notable increase in the Fluidizers Plasterboard Market, with a market size of €0.62 billion. The growth is attributed to rising construction activities, particularly in residential and commercial sectors, alongside regulatory frameworks that emphasize sustainability and energy efficiency. The European Union's commitment to reducing carbon emissions is also a significant driver, pushing for innovative building solutions that include fluidizers in plasterboard applications. Germany and France are leading the charge in this market, with key players like Knauf and Saint-Gobain making substantial contributions. The competitive landscape is marked by a focus on research and development, aiming to enhance product performance and sustainability. As the market evolves, collaboration among manufacturers and regulatory bodies will be crucial in shaping future trends and ensuring compliance with environmental standards.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is emerging as a significant player in the Fluidizers Plasterboard Market, with a market size of $0.36 billion. The growth is primarily driven by rapid urbanization, increasing infrastructure development, and a rising middle-class population demanding modern housing solutions. Government initiatives aimed at enhancing construction standards and promoting energy-efficient materials are also contributing to market expansion in this region. China and India are at the forefront of this growth, with substantial investments in construction and infrastructure projects. Key players like Boral Limited and Etex Group are actively participating in this burgeoning market. The competitive landscape is characterized by a mix of local and international companies, all vying for market share through innovative product offerings and strategic collaborations to meet the growing demand for fluidizers in plasterboard applications.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually developing its Fluidizers Plasterboard Market, currently valued at $0.06 billion. The growth is driven by increasing construction activities, particularly in the Gulf Cooperation Council (GCC) countries, where urbanization and infrastructure development are on the rise. Additionally, government initiatives aimed at enhancing building standards and promoting sustainable construction practices are expected to catalyze market growth in this region. Countries like the UAE and South Africa are leading the market, with a growing presence of international players. The competitive landscape is evolving, with local manufacturers beginning to emerge alongside established global companies. This dynamic environment presents opportunities for innovation and collaboration, as the region seeks to meet the rising demand for fluidizers in plasterboard applications.