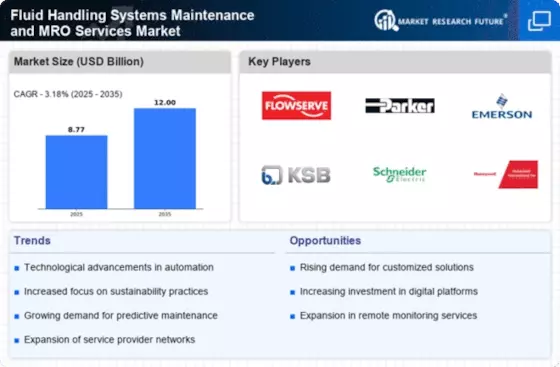

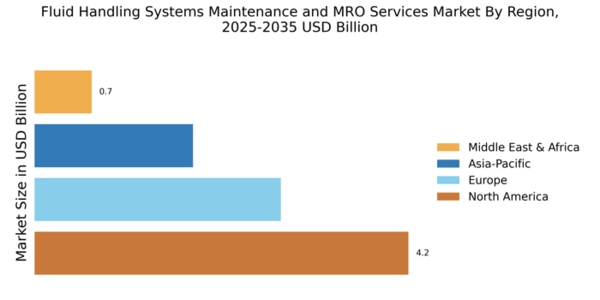

North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Fluid Handling Systems Maintenance and MRO Services Market, holding a market size of $4.25B in 2025. Key growth drivers include the increasing demand for efficient fluid management systems, stringent regulatory standards, and technological advancements in maintenance practices. The region's robust industrial base and investment in infrastructure further bolster market growth. The United States is the primary contributor to this market, with major players like Flowserve Corporation, Parker Hannifin Corporation, and Emerson Electric Co. leading the competitive landscape. The presence of these key players, along with a focus on innovation and sustainability, positions North America as a hub for fluid handling solutions. The market is expected to grow as industries seek to optimize operations and reduce downtime.

Europe : Emerging Market with Growth Potential

Europe's Fluid Handling Systems Maintenance and MRO Services Market is projected to reach $2.8B by 2025, driven by increasing industrial automation and a shift towards sustainable practices. Regulatory frameworks promoting energy efficiency and environmental protection are significant catalysts for market growth. The region's focus on innovation and technology adoption is also enhancing service delivery and operational efficiency. Germany, France, and the UK are leading countries in this market, with a competitive landscape featuring key players like KSB SE & Co. KGaA and Schneider Electric SE. The presence of these companies, along with a strong emphasis on R&D, is fostering a dynamic environment for fluid handling solutions. As industries adapt to new technologies, the demand for maintenance and MRO services is expected to rise significantly.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the Fluid Handling Systems Maintenance and MRO Services Market, with a projected size of $1.8B by 2025. Key growth drivers include industrial expansion, urbanization, and increasing investments in infrastructure. The region's diverse industrial base and rising demand for efficient fluid management solutions are propelling market dynamics, supported by favorable government policies. Countries like China, India, and Japan are at the forefront of this growth, with a competitive landscape featuring companies such as Honeywell International Inc. and SPX Flow, Inc. The increasing focus on modernization and technological advancements in these countries is driving the demand for maintenance and MRO services. As industries evolve, the need for reliable fluid handling solutions is expected to escalate, further enhancing market prospects.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region is gradually emerging in the Fluid Handling Systems Maintenance and MRO Services Market, with a market size of $0.65B projected for 2025. Key growth drivers include increasing oil and gas exploration activities, along with a growing focus on water management solutions. However, challenges such as political instability and economic fluctuations may hinder growth in certain areas. Countries like Saudi Arabia and South Africa are leading the market, with a competitive landscape that includes key players like Weir Group PLC and Xylem Inc. The presence of these companies, coupled with government initiatives aimed at improving infrastructure, is expected to drive demand for maintenance and MRO services. As the region seeks to enhance its industrial capabilities, opportunities for growth in fluid handling solutions are on the rise.