Expansion in Research Activities

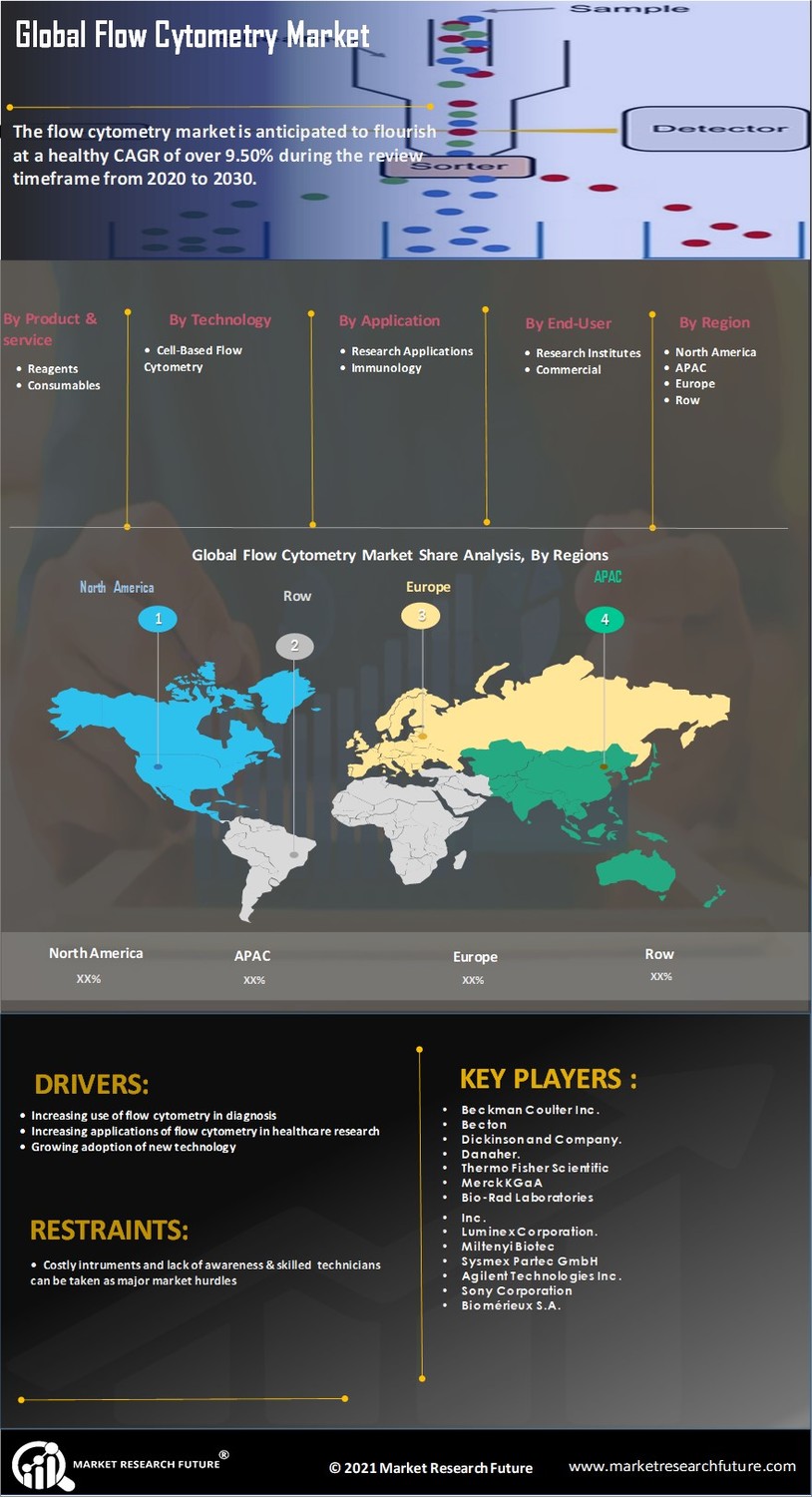

The Flow Cytometry Market is benefiting from the expansion of research activities across various fields, including immunology, cancer research, and stem cell biology. Increased funding for research initiatives and the establishment of advanced research facilities are driving the demand for flow cytometry technologies. As researchers seek to explore complex biological systems, flow cytometry provides essential insights into cell populations and their functions. The market is projected to grow as academic institutions and research organizations invest in state-of-the-art flow cytometry equipment. This expansion is likely to enhance the understanding of disease mechanisms and contribute to the development of novel therapeutic strategies.

Increased Investment in Biotechnology

The Flow Cytometry Market is poised for growth due to increased investment in biotechnology and life sciences. As governments and private sectors allocate more resources towards biopharmaceutical research and development, the demand for flow cytometry technologies is likely to rise. This investment supports the development of innovative therapies and diagnostic tools, where flow cytometry plays a pivotal role. The market is expected to benefit from collaborations between academic institutions and industry players, fostering advancements in flow cytometry applications. This trend suggests a robust future for the flow cytometry market, driven by the ongoing evolution of the biotechnology landscape.

Rising Demand for Personalized Medicine

The Flow Cytometry Market is significantly influenced by the increasing demand for personalized medicine. As healthcare shifts towards tailored treatment approaches, flow cytometry plays a crucial role in the development of targeted therapies. This technology enables the analysis of individual cell characteristics, which is essential for understanding patient-specific responses to treatments. The market is expected to witness substantial growth, with projections indicating a compound annual growth rate of over 8% in the coming years. This trend is further supported by the growing emphasis on biomarker discovery and the need for precise diagnostics, making flow cytometry an indispensable tool in personalized healthcare.

Growing Applications in Clinical Diagnostics

The Flow Cytometry Market is witnessing a surge in applications within clinical diagnostics, particularly in hematology and oncology. Flow cytometry is increasingly utilized for the diagnosis and monitoring of various diseases, including leukemia and lymphoma. The ability to analyze multiple parameters simultaneously allows for comprehensive assessments of cell populations, which is crucial for accurate diagnosis. The market for flow cytometry in clinical settings is expected to expand, driven by the rising prevalence of chronic diseases and the need for efficient diagnostic tools. This trend indicates a promising future for flow cytometry as a standard practice in clinical laboratories.

Technological Advancements in Flow Cytometry

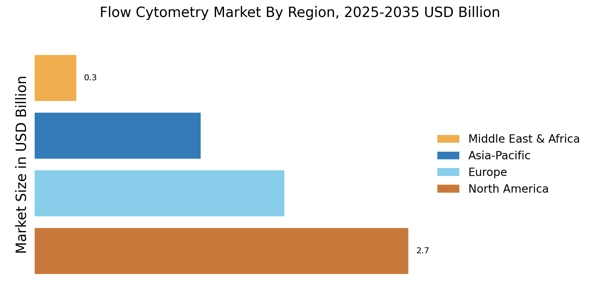

The Flow Cytometry Market is experiencing rapid technological advancements that enhance the capabilities of flow cytometers. Innovations such as multi-parameter analysis and improved laser technologies allow for more precise and efficient cell analysis. These advancements are likely to increase the adoption of flow cytometry in various applications, including immunology and oncology. The introduction of novel reagents and software solutions further supports the growth of this market. According to recent estimates, the market for flow cytometry is projected to reach USD 6.5 billion by 2026, driven by these technological improvements. As researchers and clinicians seek more accurate and reliable data, the demand for advanced flow cytometry systems continues to rise.