Market Growth Projections

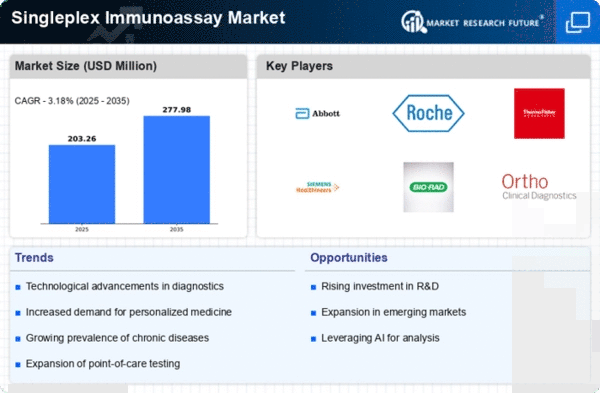

The Global Singleplex Immunoassay Market Industry is projected to experience substantial growth over the coming years. With a market value of 0.2 USD Billion in 2024, it is anticipated to reach 0.28 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.18% from 2025 to 2035. Factors contributing to this growth include rising demand for diagnostic testing, technological advancements, and increased investment in research and development. The market's expansion is likely to be driven by the continuous evolution of healthcare needs and the increasing focus on personalized medicine.

Rising Demand for Diagnostic Testing

The Global Singleplex Immunoassay Market Industry experiences a notable surge in demand for diagnostic testing across various healthcare settings. This trend is driven by the increasing prevalence of chronic diseases and the need for early detection. For instance, the market is projected to reach 0.2 USD Billion in 2024, reflecting a growing emphasis on personalized medicine and targeted therapies. As healthcare providers seek efficient and accurate testing methods, singleplex immunoassays offer a streamlined approach to diagnostics, thereby enhancing patient outcomes. This rising demand is likely to propel the market further, as stakeholders invest in innovative technologies and solutions.

Growing Focus on Point-of-Care Testing

The growing focus on point-of-care testing significantly influences the Global Singleplex Immunoassay Market Industry. As healthcare systems strive to improve patient access to diagnostics, singleplex immunoassays offer rapid results and ease of use in diverse settings. This shift towards decentralized testing is particularly relevant in rural and underserved areas, where traditional laboratory access may be limited. The convenience and efficiency of point-of-care testing are likely to drive market growth, as healthcare providers increasingly adopt these assays to enhance patient care. This trend aligns with the broader movement towards patient-centered healthcare solutions.

Technological Advancements in Assay Development

Technological advancements play a pivotal role in shaping the Global Singleplex Immunoassay Market Industry. Innovations in assay development, such as enhanced sensitivity and specificity, are driving the adoption of singleplex immunoassays in clinical laboratories. These advancements facilitate the detection of low-abundance biomarkers, which is crucial for disease diagnosis and monitoring. As a result, the market is expected to grow, reaching 0.28 USD Billion by 2035. Furthermore, the integration of automation and digital platforms in assay processes enhances efficiency and reduces turnaround times, making singleplex immunoassays more appealing to healthcare providers.

Increased Investment in Research and Development

Investment in research and development is a significant driver of the Global Singleplex Immunoassay Market Industry. As pharmaceutical and biotechnology companies focus on developing novel therapeutics, the demand for reliable diagnostic tools becomes paramount. This trend is evidenced by the projected compound annual growth rate (CAGR) of 3.18% from 2025 to 2035. Increased funding for research initiatives fosters innovation in assay technologies, enabling the development of more precise and user-friendly singleplex immunoassays. Consequently, this investment not only enhances the capabilities of existing assays but also paves the way for new applications in various fields, including oncology and infectious diseases.

Regulatory Support for Innovative Diagnostic Solutions

Regulatory support for innovative diagnostic solutions is a crucial driver of the Global Singleplex Immunoassay Market Industry. Governments and regulatory bodies are increasingly recognizing the importance of rapid and accurate diagnostics in improving public health outcomes. Streamlined approval processes for novel assays encourage manufacturers to invest in the development of singleplex immunoassays. This supportive regulatory environment fosters innovation and competition within the market, ultimately benefiting healthcare providers and patients alike. As a result, the market is poised for growth, with an increasing number of innovative products entering the landscape.