Research Methodology on Fitness App Market

Introduction

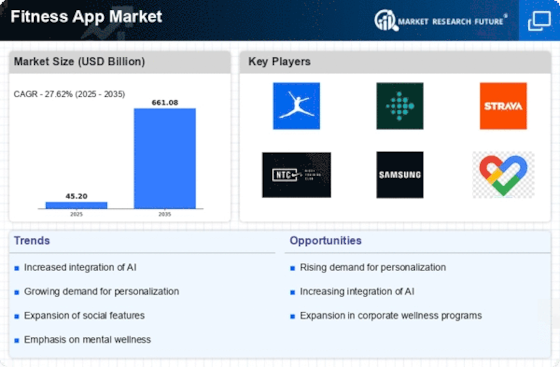

Fitness apps are a popular trend developing in the current era as they help in health consciousness and provide many health benefits. According to the fitness app market research report by Market Research Future (MRFR), the fitness app market is expected to witness tremendous growth in the future due to technological progress and awareness about health and fitness among people.

It is observed that the COVID–19 pandemic has increased the demand for fitness apps as home workouts became a prime option. This research aims to investigate the factors that impact the growth of the global fitness app market and understand the current position of the market.

Objective

The objective of this research is to analyse the factors that drive the growth of the market, understand the prevalent trends, assess opportunities, and make estimations of the growth rate through quantitative and qualitative analysis.

Research Methodology

The research methodology adopted in this study to understand the fitness app market and make estimations is a combination of both primary and secondary research.

Primary Research

Primary research includes the use of periodicals, journals, research papers, survey reports and surveys to gain in-depth insights into the present condition of the market. Moreover, personal interviews and expert opinions of industry professionals, investors and consultants are considered for the primary data collection.

Secondary Research

Secondary research for this study includes the use of existing reports, government publications, news articles and opinions from the key stakeholders in the industry. The list of sources includes medical literature, case studies, the national bureau of statistics, statics from national industry bodies, international industry bodies, websites, newspapers and official company documents.

Research Design

The research design is a mix of qualitative and quantitative approaches. The quantitative approach uses numerical data and statistical methods while the qualitative approach uses subjective evaluation and interpretation to assess the variables. This research uses regression analysis, survey method, descriptive analysis and phenomenological analysis to assess the market.

Data Collection

The data collection process of this research involves the use of a combination of both primary and secondary data. Primary data is collected through surveys, interviews and questionnaires. The surveys are conducted with various stakeholders in the industry to gain an understanding of the prevailing trends and customer needs and preferences.

Secondary data is collected from sources such as government and private agencies, industry bodies and international institutions. The sources include official reports, press releases, websites of private agencies, and medical literature. The data collected from these sources is verified to ensure accuracy and authenticity.

Research Analysis

The collected data is then analysed using statistical and econometric methods. The research employs standard measures to validate the primary and secondary data. The use of averages, indices, standard deviation, sensitivity analysis and regression analysis is used to assess the factors influencing the market growth.

Data Interpretation and Presentation

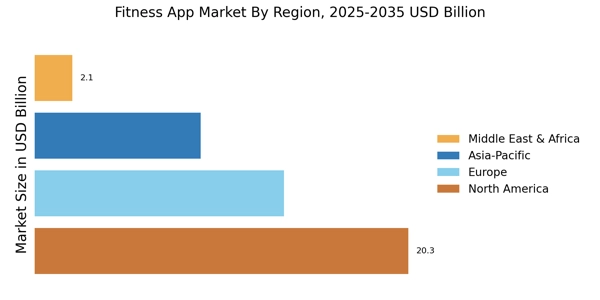

The data collected and analysed is then presented accurately and concisely. The research employs the use of tables and figures to explain the interpretation of the collected data and graphics to visualise the trends in the market. After successful data analysis, the research presents the findings in an easy-to-understand format and draws relevant conclusions.

Conclusion

The research attempts to understand the factors that drive the growth of the fitness app market thoroughly. The research uses the analysis of the market, surveys and interviews of industry professionals for primary research and study of existing studies for secondary research. The research attempts to identify the trends, opportunities and challenges in the global fitness app market and make appropriate estimations. The findings of this research provide key insights into the prospects of the market and can help the stakeholders understand the current and future position of the industry.