Increasing Oil Prices

The volatility of oil prices is a significant driver for the First Generation Biofuel Market. As oil prices fluctuate, the economic attractiveness of biofuels becomes more pronounced. When oil prices rise, consumers and industries are more inclined to seek alternative energy sources, including biofuels. In 2025, the average price of crude oil is projected to remain above 80 dollars per barrel, which could lead to a surge in biofuel adoption. This trend suggests that the First Generation Biofuel Market may experience accelerated growth as businesses and consumers look for cost-effective and sustainable energy solutions in response to rising oil prices.

Rising Demand for Renewable Energy

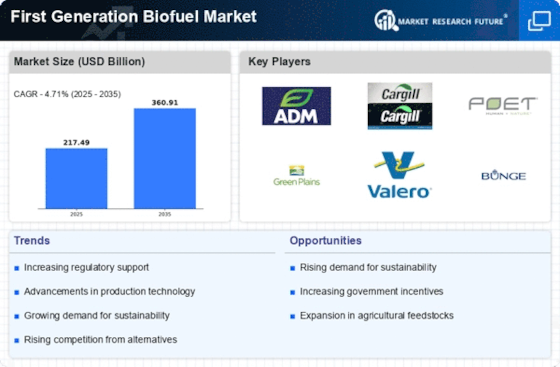

The First Generation Biofuel Market is experiencing a notable increase in demand for renewable energy sources. This trend is driven by a growing awareness of climate change and the need to reduce greenhouse gas emissions. As countries strive to meet international climate agreements, the shift towards biofuels is becoming more pronounced. In 2023, the biofuel consumption reached approximately 160 billion liters, indicating a robust growth trajectory. This demand is further fueled by the transportation sector, which is increasingly adopting biofuels as a cleaner alternative to fossil fuels. The First Generation Biofuel Market is thus positioned to benefit from this rising demand, as consumers and businesses alike seek sustainable energy solutions.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in shaping the First Generation Biofuel Market. Many governments are implementing policies to promote the use of biofuels, offering financial support to producers and consumers. For instance, tax credits and grants for biofuel production have been introduced in various regions, encouraging investment in this sector. In 2024, it was estimated that government subsidies for biofuels exceeded 10 billion dollars, highlighting the financial commitment to fostering this industry. These incentives not only enhance the economic viability of biofuels but also stimulate innovation and research, further propelling the growth of the First Generation Biofuel Market.

Consumer Preference for Sustainable Products

Consumer preference for sustainable products is increasingly influencing the First Generation Biofuel Market. As awareness of environmental issues grows, consumers are actively seeking out products that align with their values, including renewable energy sources. Surveys indicate that over 70% of consumers are willing to pay a premium for sustainable energy options, which bodes well for the biofuel sector. This shift in consumer behavior is prompting companies to invest in biofuel technologies and production methods that emphasize sustainability. Consequently, the First Generation Biofuel Market is likely to see a rise in demand as businesses respond to this consumer trend, further solidifying the role of biofuels in the energy landscape.

Technological Innovations in Biofuel Production

Technological innovations are significantly impacting the First Generation Biofuel Market. Advances in production techniques, such as improved fermentation processes and enzyme technologies, are enhancing the efficiency and yield of biofuel production. These innovations are crucial as they help reduce production costs and increase the competitiveness of biofuels against traditional fossil fuels. In recent years, the introduction of new technologies has led to a 20% increase in biofuel production efficiency, making it a more attractive option for energy producers. As these technologies continue to evolve, they are likely to further transform the First Generation Biofuel Market, enabling higher production rates and lower environmental impacts.