Increased Focus on Cybersecurity

As cyber threats continue to evolve, the Financial Risk Management Software Market is experiencing a heightened focus on cybersecurity measures. Financial institutions are increasingly recognizing the potential risks associated with cyberattacks, which can lead to significant financial losses and reputational harm. The market for cybersecurity solutions within financial risk management is projected to grow at a rate of 12% annually. This trend underscores the necessity for software that not only manages financial risks but also incorporates robust cybersecurity features. Organizations are seeking comprehensive solutions that provide real-time monitoring and threat detection capabilities. Thus, the emphasis on cybersecurity is likely to drive innovation and investment in the Financial Risk Management Software Market.

Adoption of Cloud-Based Solutions

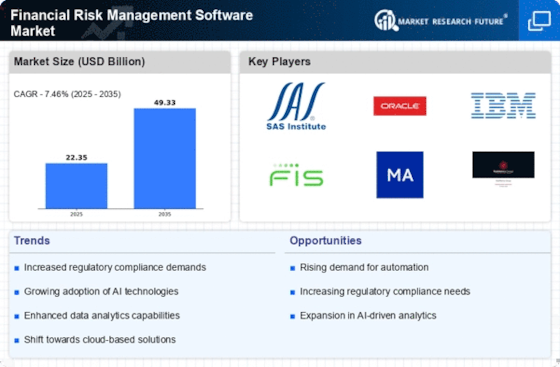

The shift towards cloud-based solutions is transforming the Financial Risk Management Software Market. Organizations are increasingly adopting cloud technologies to enhance flexibility, scalability, and cost-effectiveness in their risk management processes. Cloud-based software allows firms to access real-time data and analytics from anywhere, facilitating quicker decision-making. Recent market analysis suggests that the cloud segment of financial risk management software is expected to grow by 20% over the next few years. This growth is indicative of a broader trend towards digital transformation in the financial sector. As firms seek to optimize their operations and reduce overhead costs, the demand for cloud-based financial risk management solutions is likely to escalate, further shaping the Financial Risk Management Software Market.

Integration of Advanced Analytics

The integration of advanced analytics into the Financial Risk Management Software Market is driving substantial growth. Organizations are increasingly leveraging data analytics to enhance their risk assessment capabilities. By utilizing predictive analytics, firms can identify potential risks before they materialize, thereby mitigating financial losses. According to recent data, the market for analytics in risk management is projected to grow at a compound annual growth rate of 15% over the next five years. This trend indicates a shift towards data-driven decision-making, which is becoming essential for firms aiming to maintain a competitive edge. As a result, the demand for sophisticated financial risk management solutions that incorporate advanced analytics is likely to rise, further propelling the Financial Risk Management Software Market.

Growing Importance of Risk Culture

The growing importance of risk culture within organizations is emerging as a key driver in the Financial Risk Management Software Market. Companies are increasingly recognizing that fostering a strong risk culture is essential for effective risk management. This cultural shift encourages employees at all levels to prioritize risk awareness and accountability. As organizations strive to embed risk management into their corporate ethos, the demand for software that supports this cultural transformation is rising. Recent surveys indicate that firms with a robust risk culture are 30% more likely to achieve their strategic objectives. Consequently, the Financial Risk Management Software Market is likely to see an uptick in solutions that facilitate the development of a proactive risk culture, aligning risk management practices with organizational goals.

Rising Demand for Regulatory Compliance

The increasing complexity of regulatory requirements is a significant driver in the Financial Risk Management Software Market. Financial institutions are facing heightened scrutiny from regulatory bodies, necessitating robust compliance frameworks. The demand for software solutions that can automate compliance processes is surging, as firms seek to avoid hefty fines and reputational damage. Recent statistics indicate that compliance-related expenditures are expected to reach 10 billion dollars annually by 2026. This growing financial burden compels organizations to invest in effective risk management software that ensures adherence to regulations. Consequently, the Financial Risk Management Software Market is witnessing a surge in demand for solutions that streamline compliance and enhance overall risk management capabilities.