The Financial Literacy Education Services Market is characterized by a dynamic competitive landscape, driven by increasing awareness of financial literacy's importance in personal and professional contexts. Key players are actively engaging in various strategies to enhance their market presence and operational efficiency. For instance, the National Endowment for Financial Education (US) has focused on expanding its digital resources, aiming to reach a broader audience through innovative online platforms. Similarly, Khan Academy (US) has been enhancing its curriculum offerings, integrating interactive tools to facilitate better learning experiences. These strategic initiatives collectively contribute to a more competitive environment, as companies strive to differentiate themselves through educational quality and accessibility.In terms of business tactics, companies are increasingly localizing their content to cater to diverse demographic needs, which appears to be a crucial factor in their operational strategies. The market structure is moderately fragmented, with several organizations vying for influence. This fragmentation allows for a variety of educational approaches, yet the collective influence of major players like the Council for Economic Education (US) and Money Management International (US) is significant, as they set benchmarks for quality and effectiveness in financial literacy education.

In November Smart About Money (US) launched a new mobile application designed to provide personalized financial education resources. This strategic move is likely to enhance user engagement and accessibility, reflecting a broader trend towards mobile learning solutions. The app's features, which include budgeting tools and financial goal tracking, may position Smart About Money as a leader in the digital financial education space, appealing particularly to younger audiences who prefer mobile platforms.

In October the Jumpstart Coalition for Personal Financial Literacy (US) announced a partnership with several educational institutions to integrate financial literacy into high school curricula nationwide. This initiative underscores the organization's commitment to fostering early financial education, which could have long-term implications for improving financial literacy rates among youth. By collaborating with schools, Jumpstart Coalition is likely to enhance its visibility and credibility, potentially influencing policy changes in educational standards.

In September the Financial Literacy and Education Commission (US) released a comprehensive report outlining new strategies for enhancing financial literacy among underserved communities. This report emphasizes the importance of targeted outreach and community-based programs, suggesting a shift towards more inclusive educational practices. The commission's focus on underserved populations may catalyze further initiatives aimed at bridging the financial literacy gap, thereby reshaping the competitive landscape.

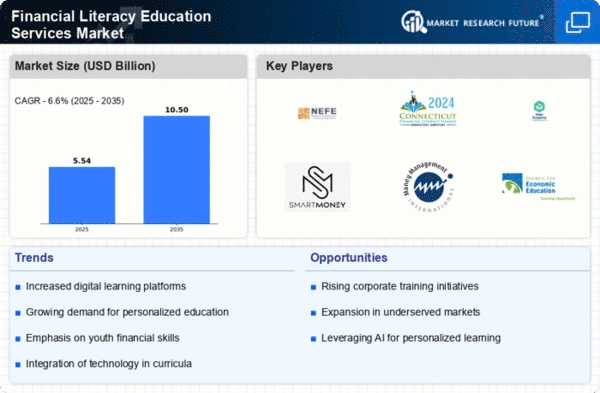

As of December current trends in the Financial Literacy Education Services Market indicate a strong emphasis on digitalization, with many organizations leveraging technology to enhance learning experiences. The integration of artificial intelligence (AI) into educational tools is becoming increasingly prevalent, allowing for personalized learning pathways. Strategic alliances among key players are also shaping the landscape, as collaborations can lead to resource sharing and enhanced program offerings. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition towards innovation and technological integration. Companies that prioritize reliable supply chains and innovative educational solutions may emerge as leaders in this evolving market.