North America : Market Leader in Financial Services

North America continues to lead the Financial Due Diligence Services Market, holding a significant share of 4.25B in 2024. The region's growth is driven by a robust economy, increasing M&A activities, and stringent regulatory requirements that demand thorough financial assessments. The presence of major financial institutions and a strong legal framework further catalyze demand for due diligence services, ensuring compliance and risk mitigation.

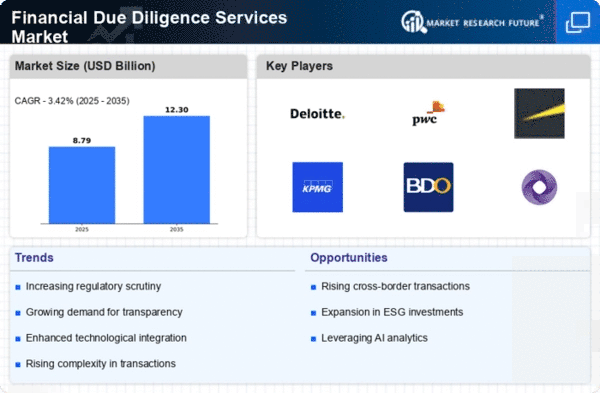

The competitive landscape is characterized by key players such as Deloitte, PwC, and EY, which dominate the market with their extensive service offerings. The U.S. and Canada are the leading countries, benefiting from advanced technological infrastructure and a skilled workforce. The ongoing trend of digital transformation in financial services is also enhancing the efficiency and effectiveness of due diligence processes, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe's Financial Due Diligence Services Market is valued at 2.8B, reflecting a growing demand driven by increasing cross-border transactions and regulatory scrutiny. The region is witnessing a surge in M&A activities, prompting companies to seek comprehensive financial assessments to ensure compliance and mitigate risks. Regulatory frameworks, such as the EU's Anti-Money Laundering Directive, are also pushing firms to enhance their due diligence processes, thereby fueling market growth.

Leading countries in this region include the UK, Germany, and France, where major players like KPMG and BDO are well-established. The competitive landscape is evolving, with firms increasingly adopting technology-driven solutions to improve service delivery. The presence of a diverse range of financial institutions and a focus on transparency are key factors contributing to the region's growth in financial due diligence services.

Asia-Pacific : Rapidly Growing Financial Sector

The Asia-Pacific region, valued at 1.8B, is rapidly emerging in the Financial Due Diligence Services Market, driven by economic growth and increasing foreign investments. Countries like China and India are witnessing a surge in M&A activities, necessitating comprehensive financial evaluations to navigate complex regulatory environments. The region's growth is further supported by government initiatives aimed at improving business transparency and attracting foreign capital, which enhances the demand for due diligence services.

Key players in this market include local firms and international giants like EY and PwC, which are expanding their presence to cater to the growing demand. The competitive landscape is marked by a mix of established firms and new entrants, all vying for market share. As the region continues to develop, the focus on compliance and risk management will drive further growth in financial due diligence services.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region, with a market size of 0.65B, is gradually emerging in the Financial Due Diligence Services Market. The growth is primarily driven by increasing foreign investments and a rising number of M&A transactions. Governments in the region are implementing regulatory reforms aimed at enhancing transparency and attracting international businesses, which is expected to boost demand for due diligence services significantly.

Countries like South Africa and the UAE are leading the way, with a growing presence of international firms such as Grant Thornton and Mazars. The competitive landscape is evolving, with local firms gaining traction alongside established players. As the region continues to develop its financial infrastructure, the demand for comprehensive due diligence services is anticipated to rise, presenting significant opportunities for growth.