Fiberglass Pipes Size

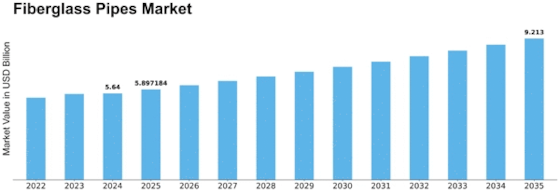

Fiberglass Pipes Market Growth Projections and Opportunities

The fiberglass pipes market is driven by several key factors that shape its growth and development. One significant driver is the increasing demand for corrosion-resistant and lightweight piping solutions across various industries. Fiberglass pipes offer excellent corrosion resistance properties, making them ideal for transporting corrosive fluids such as acids, chemicals, and saltwater in industries such as oil and gas, chemical processing, water treatment, and marine. Additionally, fiberglass pipes are lightweight, durable, and have a longer service life compared to traditional materials like steel and concrete. As industries seek cost-effective and long-lasting piping solutions to address corrosion and maintenance issues, the demand for fiberglass pipes continues to rise, driving market growth.

Technological advancements in fiberglass pipe manufacturing processes also play a crucial role in driving market expansion. Manufacturers are continually innovating to improve production techniques, enhance product quality, and develop customized solutions tailored to meet specific customer requirements. Advanced filament winding, pultrusion, and centrifugal casting processes enable the production of fiberglass pipes with precise dimensions, high structural integrity, and superior performance characteristics. Additionally, advancements in resin formulations and reinforcement materials contribute to the development of fiberglass pipes with enhanced mechanical properties, further fueling market demand.

Moreover, regulatory standards and environmental considerations influence the fiberglass pipes market dynamics. Regulatory bodies impose stringent standards and codes regarding the performance, safety, and quality of piping materials used in various industries. Compliance with regulations such as ASTM, API, and AWWA is essential for fiberglass pipe manufacturers to ensure product reliability and meet customer requirements. Additionally, growing environmental concerns about the sustainability and carbon footprint of infrastructure projects drive the adoption of eco-friendly materials like fiberglass, further influencing market dynamics.

The competitive landscape of the fiberglass pipes market also impacts its growth trajectory. With numerous players competing for market share, competition is intense in terms of product quality, innovation, and pricing. Manufacturers invest in research and development to introduce new fiberglass pipe formulations, improve production efficiency, and develop customized solutions tailored to meet specific industry needs. Strategic collaborations, partnerships, and acquisitions are common strategies employed by companies to expand their market presence and gain a competitive edge.

Furthermore, economic factors such as GDP growth, industrial output, and infrastructure development impact the fiberglass pipes market. Economic growth stimulates investment in infrastructure projects such as water supply systems, wastewater treatment plants, and oil and gas pipelines, driving the demand for fiberglass pipes. Moreover, increasing urbanization, population growth, and industrialization lead to higher demand for reliable and durable piping solutions, further fueling market growth.

Leave a Comment