Fermented Milk Size

Fermented Milk Market Growth Projections and Opportunities

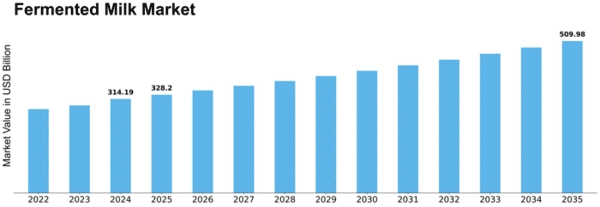

The Fermented Milk Products market is influenced by a myriad of factors that collectively drive its growth and dynamics. One primary factor is the increasing awareness of the health benefits associated with fermented dairy products. Consumers are becoming more health-conscious, and fermented milk products, such as yogurt and kefir, are recognized for their probiotic content, which contributes to digestive health and overall well-being. Followed by the heightened consciousness, the public has been able to massively develop their desire to consume fermented milk products which both adds up to the list of the favorites in the global dairy industry. The Fermented Milk Products Market evaluation report by forecasts US$ 399.87 billion by 2030 with a 5.8% Compound Annual Growth Rate (CAGR) falling in the period from 2022 through 2030 — indicating a sustainable market growth and maintainable success.

Natural and clean label characteristics of the goods are the other determining factor on the market, keeping in view the current tendency. It makes sense to keep fermented milk products on the mind because they are regarded as pure and uncomplicatedly prepared. The shopper has led to increased agitation of artificial additives and preservatives, thus they are seeking a natural- organic fermented milk which is in demand. This trend can be observed not only in the already existing dairy market but also in the new emerging area with a growing demand for fermented plant-based alternatives which are gradually gaining popularity and becoming one of the most sought-after categories in the dairy products market.

Furthermore, the prospect of technical development in the course of milk products making and filling is of no small importance as well. Introductions of novel fermentation methods and other processes used in production also impacts the final product's quality, taste, and durability. The cutting edge process is production and dissemination of fermented milk products to the worldwide consumer market. This makes the sour milk products more accessible to them. Such tech advances do not only play a big part in deciding who will compete for the market share but also, in shaping the competitive landscape of the market.

Sustainability in the dairy industry's endeavors and the environmental concerns which impact the Fermented Milk Products market are all interlinked. The environmentally aware and conscience consumers are now requiring the dairy product producers and packaging designers to involve the sustainable and environment-friendly practices in the manufacturing and packaging processes. The market is facing growing concerns about environmental footprint which inspires producers to come up with practices that protect the ecosystem such as green sourcing of natural resources and sustainable packaging.

Economy is also another element that affects market situations. The income level, the purchasing power of the consumers, and the financial stability of the people determine the way consumers distribute their expenditure on food items, including fermented milk consumer goods. Market participants need to adapt to changing economic conditions and consumer behaviors to maintain their market share and competitiveness.

Leave a Comment