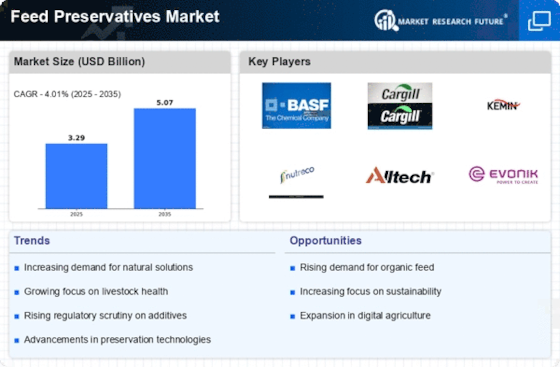

Market Share

Feed Preservatives Market Share Analysis

The growth and well-being of livestock animals depend on feed preservatives, which help provide nutrient-rich feed. Animal reproduction, lactation, and brand equity benefit from this nutritionally dense feed.

Due to animal nutrition changes and feed quality demands, the feed preservatives industry has changed significantly. Animal feed preservatives prevent spoilage germs and extend shelf life. Natural and organic feed preservatives are becoming more popular. Livestock and poultry farmers are pursuing feed preservatives made from organic acids, essential oils, and plant extracts as customer tastes change toward sustainable and clean-label products. Industry-wide, synthetic chemicals in animal feeds are being reduced in response to customer demands and regulatory developments.

Due to mycotoxin contamination concerns in animal feeds, feed preservative demand is rising. Molds that infect grains and forages create mycotoxins, which can harm animals and reduce performance. Thus, feed preservatives with antifungal qualities, such as propionic acid and its salts, are increasingly used to prevent mold development and mycotoxin concerns. This trend shows how important feed preservatives are for animal feed safety and quality.

Sustainability drives feed preservatives market raw material procurement and production environmental effect. Manufacturers are investigating eco-friendly feed preservative ingredient sourcing and manufacture. This trend aligns with the industry's sustainable agricultural and responsible production goals. Feed preservative providers are shifting to satisfy the needs of ecologically aware farmers as sustainability becomes more important.

Feed preservative formulations are improving to meet feed type and production system issues. Feed preservatives are being improved for pelleted, complete, and mixed feeds. This shows the industry's dedication to offering farmers customized solutions that meet the needs of varied animal species and production situations.

The feed preservatives business is heavily influenced by government laws and worldwide trade. Feed preservatives are being used to avoid mycotoxin contamination as regulatory organizations focus on feed safety. To maintain product quality and safety, worldwide feed and feed ingredient trading must follow regulatory criteria. Compliance with regulatory standards and the demand for standardized, internationally acknowledged feed preservative solutions determine market developments.

The feed preservatives market is changing due to rising demand for natural and organic solutions, feed hygiene awareness, mycotoxin contamination concerns, sustainability concerns, formulation advances, regulatory influences, global trade dynamics, and technological innovations. As the animal production business prioritizes feed quality, animal health, and sustainability, the feed preservatives market will help livestock and poultry globally.

Leave a Comment