Market Growth Projections

The Global Feed Phytogenic Market Industry is projected to experience substantial growth over the next decade. With a market value of 0.56 USD Billion in 2024, it is anticipated to reach 1.74 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate of 10.77% from 2025 to 2035. Factors contributing to this expansion include rising consumer demand for natural feed additives, increased regulatory support, and growing awareness of animal welfare. As the market evolves, it is likely to attract new players and foster innovation, further enhancing the development of phytogenic solutions in the livestock sector.

Expansion of Livestock Production

The Global Feed Phytogenic Market Industry is poised for growth due to the expansion of livestock production globally. As populations increase and dietary preferences shift towards protein-rich foods, the demand for livestock products rises. This trend necessitates the adoption of efficient feeding strategies, where phytogenic additives play a crucial role. By enhancing feed efficiency and promoting animal health, these natural additives can help meet the rising demand for meat, dairy, and eggs. The market's value is anticipated to grow significantly, with estimates suggesting it could reach 1.74 USD Billion by 2035, driven by the need for sustainable livestock production practices.

Growing Awareness of Animal Welfare

The Global Feed Phytogenic Market Industry is significantly influenced by the increasing awareness of animal welfare among consumers and producers alike. This trend is prompting livestock producers to adopt practices that prioritize animal health and well-being, which often includes the use of phytogenic feed additives. These natural products are believed to improve digestion and overall health, thereby enhancing the quality of animal products. As consumers demand higher welfare standards, the market for phytogenic additives is likely to grow, with a projected CAGR of 10.77% from 2025 to 2035. This shift towards ethical farming practices is expected to drive innovation and investment in the phytogenic sector.

Rising Demand for Natural Feed Additives

The Global Feed Phytogenic Market Industry experiences a notable increase in demand for natural feed additives as livestock producers seek alternatives to synthetic additives. This shift is driven by consumer preferences for organic and natural products, which are perceived as healthier. In 2024, the market is valued at 0.56 USD Billion, reflecting a growing awareness of the benefits of phytogenic compounds. These natural additives are believed to enhance animal health, improve feed efficiency, and reduce reliance on antibiotics, aligning with global trends towards sustainability in agriculture. As a result, the industry is poised for significant growth in the coming years.

Regulatory Support for Phytogenic Products

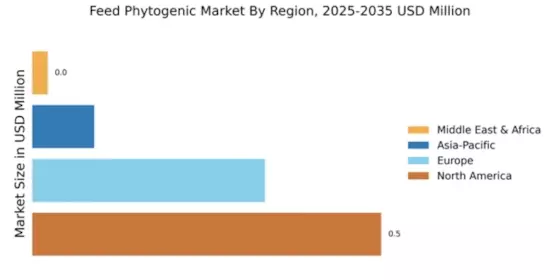

The Global Feed Phytogenic Market Industry benefits from increasing regulatory support for the use of phytogenic products in animal feed. Governments worldwide are recognizing the importance of reducing antibiotic use in livestock, leading to favorable policies that promote natural alternatives. This regulatory environment encourages research and development of phytogenic solutions, which are often viewed as safer and more sustainable. As regulations tighten around synthetic additives, the market is expected to expand, with projections indicating a growth trajectory that could see the market reach 1.74 USD Billion by 2035. This supportive framework is likely to enhance the adoption of phytogenic products across various regions.

Technological Advancements in Phytogenic Extraction

The Global Feed Phytogenic Market Industry is benefiting from technological advancements in the extraction and formulation of phytogenic compounds. Innovations in extraction methods allow for higher yields and better quality of active ingredients, making these products more effective and appealing to livestock producers. Enhanced formulations can improve the bioavailability of phytogenic compounds, leading to better animal performance and health outcomes. As these technologies evolve, they are likely to attract investment and drive market growth. The industry is expected to see a compound annual growth rate of 10.77% from 2025 to 2035, reflecting the potential of these advancements to transform feed additive applications.