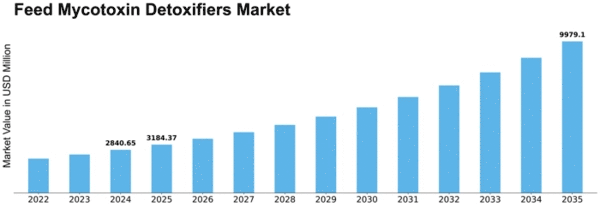

Feed Mycotoxin Detoxifiers Size

Feed Mycotoxin Detoxifiers Market Growth Projections and Opportunities

The Market for Mycotoxin Detoxifiers is affected by many things that, together, decide how it grows and changes. These factors also play a big part in its overall workings within the industry. It is very important for those who work in the field to understand these market factors. This helps them make right choices, overcome difficulties and use new chances from detoxifiers for mycotoxin treatment sector properly. The spread and bad effects of mycotoxin in animal food have a big impact on the market. High levels of dirt make animals need strong ways to get rid of bad effects on their health and performance. Weather conditions are very important in making mycotoxins. Things like heat, moisture and the weather help fungi grow more. This impacts how much we want detox things in different places based on these factors too. Farming methods, like growing crops and keeping track of them affect how much mycotoxin happens. Certain plants, ways of planting and storing food stuffs can change mycotoxin levels. This means we need special cleaners to keep animal feed safe from harmful things. People learning more about safe food and making stricter rules for mycotoxins in foods make us need better cleaners. Following the rules and making customers happy are important things for this business. Changes in how farms work and ways of caring for animals that are part of the livestock business impact demand for mycotoxin cleaners. As the animal farming area changes, so does our need for new ways to clean up. Keep in mind, improvements to feed technology change how detoxifiers are made. Changes in making things, ways to give them and knowing how mycotoxins work help the growth of solutions for getting rid of harmful stuff. This is found in markets nowadays. Trade worldwide laws, such as buying and selling rules affect how feed mycotoxin detoxifiers are found and given out. Altered trade rules and worldwide teamwork can affect how easy it is to enter markets and compete. The mycotoxin types found in different areas or linked to specific plants affect how detoxifier medicines are made. We need to make detoxifiers that can deal with all kinds of mycotoxins found in food. This will keep everything safe from harm. Finding and taking advantage of new market chances is very important. As new problems with mycotoxins come up or more areas get a lot of contamination, there is a bigger need for good ways to clean out the bad stuff. Continued research in mycotoxin detoxification makes the market progress by improving things. Companies that put money into new methods help make better and more useful cleaners. This makes them stronger compared to others.

Leave a Comment