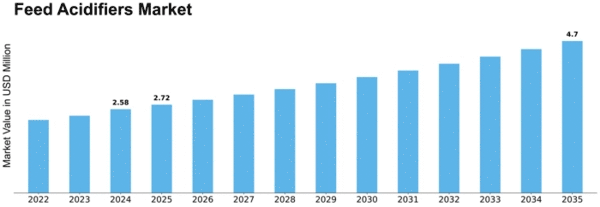

Feed Acidifiers Size

Feed Acidifiers Market Growth Projections and Opportunities

Feed Acidifiers Market play a pivotal role in determining the success of companies within the industry. With the increasing demand for feed acidifiers due to their benefits in animal nutrition, companies are adopting various strategies to capture and maintain their market share.

One common strategy employed by companies is differentiation. This involves offering unique products or services that set them apart from competitors. In the feed acidifiers market, companies may differentiate their products through innovative formulations, specialized blends, or unique delivery systems. By offering something distinct, companies can attract customers who are looking for specific solutions to their animal nutrition challenges.

Another key strategy is pricing. Companies may choose to position themselves in the market by offering products at different price points. Some may opt for a premium pricing strategy, targeting customers who are willing to pay more for higher quality or specialized products. Others may adopt a cost leadership strategy, aiming to capture market share by offering competitive prices. By strategically pricing their products, companies can appeal to different segments of the market and gain a competitive edge.

Furthermore, companies may focus on building strong relationships with customers to maintain their market share. This can involve providing exceptional customer service, offering customized solutions, or establishing loyalty programs. By prioritizing customer satisfaction and retention, companies can strengthen their position in the market and prevent customers from switching to competitors.

In addition to these strategies, companies may also invest in marketing and advertising to increase their visibility and market share. This can include targeted campaigns, digital marketing efforts, or participation in industry events and trade shows. By effectively promoting their products and brand, companies can attract new customers and reinforce their position in the market.

Furthermore, strategic partnerships and collaborations can also play a crucial role in market share positioning. By teaming up with complementary businesses or forming alliances with key players in the industry, companies can expand their reach and access new markets. Collaborations can also lead to synergies, allowing companies to leverage each other's strengths and resources to gain a competitive advantage.

Moreover, continuous innovation is essential for companies to stay ahead in the feed acidifiers market. This involves researching and developing new products, improving existing formulations, and staying abreast of emerging trends and technologies. By constantly innovating, companies can differentiate themselves from competitors and meet the evolving needs of customers. The European Union has emerged as the largest purchaser of feed acidifiers up to the present time. In 2019, its market share stood at 38.15%. Notably, the region's Compound Annual Growth Rate (CAGR) is marginally lower than the global average, at 4.4%, compared to the global CAGR of 4.9%, projected until 2027.

A primary factor driving the European Union's dominant market share is the health consciousness among its consumers. European individuals exhibit discerning dietary habits, prioritizing foods that contribute to a healthy digestive system and overall well-being. Consequently, there is a strong preference for meat and poultry sourced from animals raised on diets conducive to promoting gut health. Furthermore, an expanding body of recent medical research underscores the correlation between consuming meat and poultry with a healthy gut and digestive system and longevity, as well as enhanced personal health.

Leave a Comment