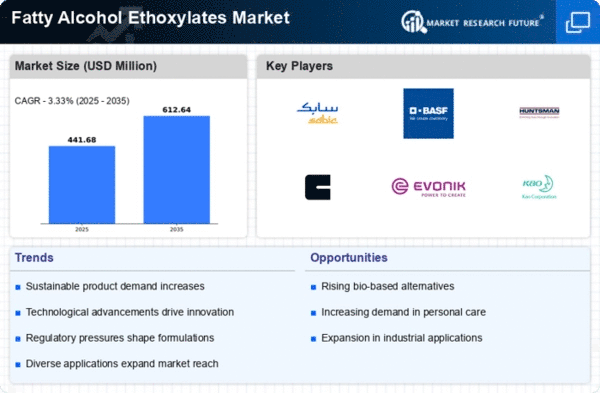

Market Growth Projections

The Global Fatty Alcohol Ethoxylates Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 3.26 USD Billion in 2024 and further expand to 5.4 USD Billion by 2035, the industry is poised for a compound annual growth rate of 4.71% from 2025 to 2035. This growth is indicative of the increasing applications of fatty alcohol ethoxylates across various sectors, including personal care, industrial, and agricultural markets. The upward trajectory suggests a robust demand for these compounds, driven by evolving consumer preferences and industrial needs.

Regulatory Support and Industry Standards

The Global Fatty Alcohol Ethoxylates Market Industry is supported by regulatory frameworks that promote the safe use of chemical products. Governments and industry associations are establishing guidelines that ensure the safety and efficacy of fatty alcohol ethoxylates in various applications. This regulatory support not only fosters consumer confidence but also encourages manufacturers to invest in research and development, leading to innovative product offerings. As compliance with these standards becomes increasingly important, the market is expected to grow, driven by the need for safe and effective solutions across multiple sectors.

Industrial Applications and Surfactant Demand

The Global Fatty Alcohol Ethoxylates Market Industry is significantly influenced by the rising demand for surfactants across various industrial applications. Industries such as textiles, agriculture, and oil and gas utilize fatty alcohol ethoxylates for their superior wetting and emulsifying properties. The versatility of these compounds allows for their incorporation into a wide range of formulations, enhancing performance and efficiency. As industrial sectors expand, the demand for effective surfactants is likely to grow, contributing to a compound annual growth rate of 4.71% from 2025 to 2035, thereby solidifying the market's position in the global economy.

Technological Advancements in Production Processes

The Global Fatty Alcohol Ethoxylates Market Industry benefits from ongoing technological advancements in production processes. Innovations in manufacturing techniques enhance the efficiency and cost-effectiveness of fatty alcohol ethoxylate production, allowing for higher yields and improved product quality. These advancements may also facilitate the development of new formulations that cater to specific industry needs, further expanding the market's reach. As production capabilities improve, the industry is likely to see increased competition and a broader range of products available to consumers, contributing to overall market growth.

Shift Towards Sustainable and Biodegradable Products

The Global Fatty Alcohol Ethoxylates Market Industry is witnessing a shift towards sustainable and biodegradable products, driven by increasing environmental awareness among consumers and regulatory bodies. Manufacturers are responding to this trend by developing eco-friendly formulations that utilize fatty alcohol ethoxylates derived from renewable resources. This transition not only meets consumer demands for sustainability but also aligns with global initiatives aimed at reducing environmental impact. As a result, the market is poised for growth, with projections indicating a potential increase in value as companies innovate to meet these evolving standards.

Growing Demand in Household and Personal Care Products

The Global Fatty Alcohol Ethoxylates Market Industry experiences a notable surge in demand driven by the increasing use of these compounds in household and personal care products. Fatty alcohol ethoxylates serve as effective surfactants, enhancing the cleaning and emulsifying properties of various formulations. As consumers become more conscious of product efficacy and safety, manufacturers are incorporating these ingredients into their offerings. This trend is reflected in the projected market value of 3.26 USD Billion in 2024, with expectations to reach 5.4 USD Billion by 2035, indicating a robust growth trajectory fueled by consumer preferences.