Market Share

Fat Replacers Market Share Analysis

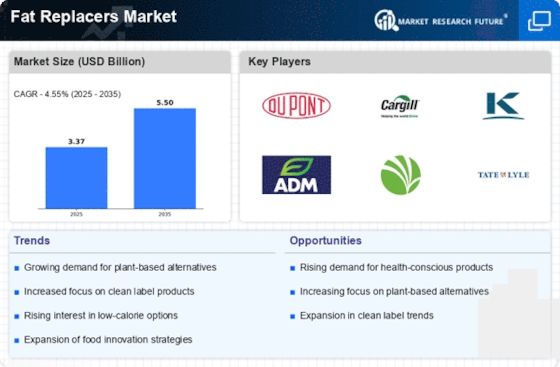

In the dynamic landscape of the Fat Replacers Market, companies employ a variety of market share positioning strategies to thrive in a competitive environment. Differentiation emerges as a crucial approach, with companies emphasizing unique qualities of their fat replacers. Such kind of promotional activities may include introducing healthier versions to the category, say, fat-free or low-calorie products, as well as highlighting functionality of the product such as improved feel or taste. To highlight these uncommon healthy features, the manufacturers try and win over health-conscious customers by presenting their goods as the alternative energy sources for people who want to have a rest from traditional fats and by building an identity of their brands. Low pricing is one of the major disciplines followed by the competitors in the substituted oils market. Those firms seek to streamline the production, purchase the highest quality ingredients affordable, and applying the reuse of materials (economies of scale). At their prices, the producers of such fat replacers target a broad consumer market, with the hope of establishing their brands as a cost-effective yet health-conscious choice for the use of such ingredients on the market, and by doing so, they position themselves to obtain a significant market share through the use of competitive pricing. The market shares of Fat Replacers Market are divvied in accordance with types that includes but not restricted to protein, starch, and lipid. Sugar constitutes a major ingredient that accounts for most of pottage, with proteins coming second. Being able to enjoy starches in frozen treats and dairy foods is quickly becoming the leading factor in increased sales, and therefore starch is a major contributor to the market share of these products. Niche specialization is one more of effective tactics. Firms may narrow down on the fat reducers category by offering products targeting dairy replacements, baked products or savory snacks families. Products to cater for the unique demands of a specific genre of food enables the firm to establish the niche of excellence, thus helping to build brand loyalty and become more competitive. Destination marketing as well as great promotional activities play a big part in the development of the Fat Replacers Market. Companies that produce these low-fat alternatives spend quite a sum of money to give their brands the right identity with information-packed packaging, and emphasis on the benefits of the fat replacers. Engaging with consumers through social media platforms, participating in health and wellness events, and providing educational content contributes to building brand loyalty and influencing purchasing decisions in a market driven by health-conscious consumer choices.

Leave a Comment