Sustainability Initiatives

Sustainability initiatives are becoming increasingly relevant within the Farm Tractor Tire Market. As environmental concerns gain prominence, manufacturers are focusing on producing eco-friendly tires that minimize environmental impact. This includes the use of sustainable materials and processes in tire production. For example, some companies are exploring the use of recycled rubber and bio-based materials, which could significantly reduce the carbon footprint associated with tire manufacturing. Additionally, the push for sustainable farming practices is prompting farmers to invest in tires that offer better performance while being environmentally responsible. The market for sustainable tires is projected to grow, as consumers become more aware of their purchasing choices. This trend not only reflects a shift in consumer preferences but also indicates a broader movement towards sustainability in agriculture, which is likely to influence the Farm Tractor Tire Market in the coming years.

Increased Focus on Customization

The Farm Tractor Tire Market is witnessing an increased focus on customization, driven by the diverse needs of farmers across various regions. Different agricultural practices require specific tire characteristics, such as tread design and size, to optimize performance. As a result, manufacturers are offering tailored solutions that cater to the unique requirements of different crops and terrains. This trend is particularly evident in regions with varying soil types and farming methods, where a one-size-fits-all approach is often inadequate. Customization not only enhances the efficiency of farm operations but also improves safety and reduces wear on equipment. The growing demand for specialized tires is likely to propel innovation within the industry, as companies strive to meet the specific needs of their customers. Consequently, this focus on customization is expected to play a pivotal role in shaping the future of the Farm Tractor Tire Market.

Rising Agricultural Mechanization

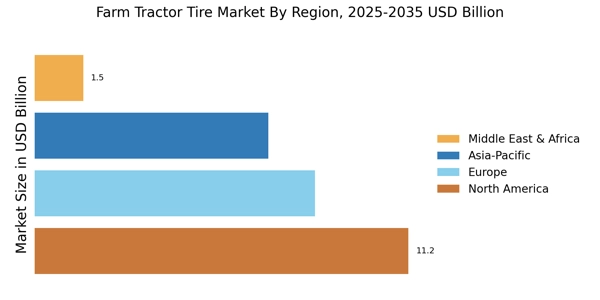

Rising agricultural mechanization is a significant driver of growth in the Farm Tractor Tire Market. As farmers increasingly adopt advanced machinery to enhance productivity, the demand for high-quality tires that can withstand rigorous use is on the rise. Mechanization allows for more efficient planting, harvesting, and maintenance, which is essential for meeting the food demands of a growing population. The trend towards larger and more powerful tractors necessitates the development of tires that can support increased weight and provide better traction. According to recent data, The Farm Tractor Tire Market is projected to grow, which will likely correlate with an uptick in tire sales. This relationship underscores the importance of robust tire solutions in supporting the mechanization trend. As such, the Farm Tractor Tire Market is poised for expansion as mechanization continues to evolve.

Economic Growth in Emerging Markets

Economic growth in emerging markets is contributing to the expansion of the Farm Tractor Tire Market. As these economies develop, there is a marked increase in agricultural investment, leading to higher demand for farming equipment, including tractors and their associated tires. The rise in disposable income among farmers enables them to upgrade their machinery, which often includes purchasing new tires that offer better performance and durability. Additionally, government initiatives aimed at boosting agricultural productivity are further driving this trend. For instance, subsidies for modern farming equipment can lead to increased tire sales as farmers seek to enhance their operational efficiency. This economic momentum in emerging markets presents a substantial opportunity for tire manufacturers, as they look to capitalize on the growing demand for high-quality farm tractor tires. The Farm Tractor Tire Market is likely to benefit from this trend as it aligns with broader economic developments.

Technological Advancements in Tire Design

The Farm Tractor Tire Market is experiencing a notable transformation due to technological advancements in tire design. Innovations such as improved tread patterns and materials enhance traction and durability, which are critical for agricultural applications. For instance, the introduction of radial tires has been linked to better fuel efficiency and reduced soil compaction, which is essential for sustainable farming practices. As farmers increasingly seek to optimize their operations, the demand for high-performance tires is likely to rise. Furthermore, advancements in tire monitoring systems, which provide real-time data on tire pressure and wear, are becoming more prevalent. This technology not only extends the lifespan of tires but also contributes to overall operational efficiency. Consequently, these developments are expected to drive growth in the Farm Tractor Tire Market, as they align with the evolving needs of modern agriculture.