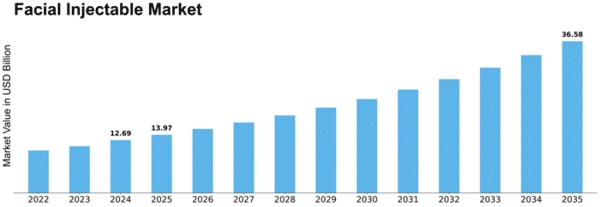

Facial Injectable Size

Facial Injectable Market Growth Projections and Opportunities

The facial injectable market is influenced by various market factors that contribute to its growth and dynamics. One key factor driving the expansion of this market is the increasing demand for non-invasive cosmetic procedures. As individuals seek less intrusive alternatives to traditional surgical interventions, facial injectables offer a viable solution to address signs of aging and enhance facial features. The rising awareness of these minimally invasive procedures, coupled with the desire for quick and effective results, propels the market forward.

Another significant market factor is the continuous advancements in technology and product innovation within the facial injectable sector. Manufacturers and researchers are consistently developing new formulations and techniques to improve the safety, efficacy, and longevity of facial injectables. These innovations not only attract a larger customer base but also foster competition among market players, driving further research and development efforts. As a result, the market witnesses a continuous influx of novel products, creating a dynamic landscape.

Furthermore, the aging population across the globe plays a crucial role in the growth of the facial injectable market. With a rising number of individuals entering the age bracket where signs of aging become more prominent, there is an increased demand for cosmetic procedures to maintain a youthful appearance. The desire to stay aesthetically pleasing in a society that places a premium on youthful looks fuels the adoption of facial injectables as a popular choice for cosmetic enhancement.

Social and cultural factors also contribute significantly to the market dynamics of facial injectables. Changing beauty standards and an increased acceptance of cosmetic procedures as a means of self-care contribute to the growing popularity of facial injectables. Moreover, the influence of social media, where visual appearance is often emphasized, plays a role in creating a heightened awareness and acceptance of facial enhancement procedures.

Regulatory factors are pivotal in shaping the facial injectable market landscape. Stringent regulations regarding the approval and marketing of these products ensure their safety and efficacy. As regulatory bodies implement guidelines to safeguard consumer interests, market players are compelled to adhere to rigorous standards, enhancing overall product quality and patient safety. This regulatory framework also acts as a barrier to entry, preventing substandard products from entering the market.

Economic factors, such as disposable income and healthcare expenditure, contribute to the market's growth. As economies develop and individuals experience an increase in disposable income, they are more likely to invest in cosmetic procedures, including facial injectables. Additionally, the expansion of healthcare infrastructure and the availability of these procedures in a wider range of healthcare facilities contribute to market growth.

Leave a Comment