Integration of Smart Technologies

The integration of smart technologies into the Fabric Filter Market is emerging as a transformative trend. The adoption of Internet of Things (IoT) devices and advanced monitoring systems allows for real-time data collection and analysis, enhancing the operational efficiency of fabric filters. These smart systems can predict maintenance needs, optimize filter performance, and reduce downtime, which is particularly beneficial in sectors such as pharmaceuticals and food processing. As industries increasingly prioritize efficiency and cost-effectiveness, the market for smart fabric filters is projected to expand significantly. Analysts suggest that the incorporation of smart technologies could lead to a market growth rate of around 6% annually over the next few years, as companies recognize the value of data-driven decision-making in their filtration processes.

Rising Demand from Emerging Economies

Emerging economies are witnessing a surge in industrial activities, which is driving the demand for the Fabric Filter Market. As countries in Asia and Latin America continue to industrialize, the need for effective air pollution control measures becomes increasingly critical. Industries such as textiles, chemicals, and food processing are expanding rapidly, necessitating the implementation of efficient filtration systems to comply with environmental regulations. Market analysts project that the demand for fabric filters in these regions could increase by approximately 30% over the next five years, as companies invest in modern filtration technologies to enhance their operational capabilities. This trend indicates a significant opportunity for manufacturers to expand their market presence in these burgeoning economies.

Technological Advancements in Filtration

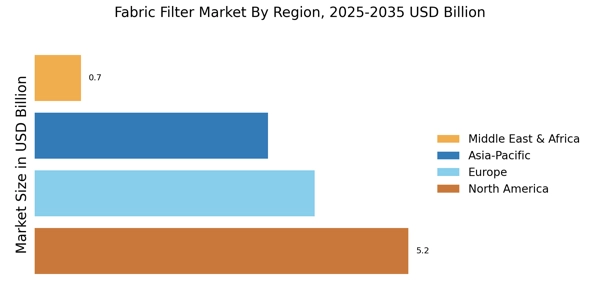

The Fabric Filter Market is experiencing a notable transformation due to rapid technological advancements. Innovations in materials and design are enhancing the efficiency and durability of fabric filters. For instance, the introduction of nanofiber technology has significantly improved filtration performance, allowing for finer particulate capture while maintaining airflow. This advancement is particularly relevant in industries such as cement and power generation, where stringent emission standards are in place. As a result, the market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, driven by the demand for more efficient filtration solutions. Furthermore, the integration of automation in filter maintenance is expected to reduce operational costs, thereby attracting more industries to adopt advanced fabric filter systems.

Focus on Energy Efficiency and Cost Reduction

The emphasis on energy efficiency and cost reduction is a driving force in the Fabric Filter Market. Industries are increasingly seeking filtration solutions that not only meet regulatory requirements but also minimize operational costs. Advanced fabric filters are designed to operate with lower energy consumption, which is particularly appealing in energy-intensive sectors such as cement and steel manufacturing. The potential for reduced energy costs, coupled with the longevity of modern fabric filters, presents a compelling case for investment. Market forecasts indicate that the demand for energy-efficient filtration systems could lead to a market growth rate of around 5.5% annually in the coming years. This focus on cost-effective solutions is likely to shape the future landscape of the fabric filter market.

Regulatory Compliance and Environmental Awareness

Increasing regulatory compliance and heightened environmental awareness are pivotal drivers in the Fabric Filter Market. Governments worldwide are implementing stricter emission regulations to combat air pollution, compelling industries to adopt advanced filtration technologies. For example, the introduction of the European Union's Industrial Emissions Directive has necessitated the use of fabric filters in various sectors, including waste incineration and metal production. This regulatory landscape is expected to propel the market, as companies seek to meet compliance standards while minimizing their environmental footprint. The market is anticipated to witness a surge in demand, with estimates suggesting a potential increase in market size by over 20% in the next five years. Consequently, industries are investing in fabric filter technologies that not only comply with regulations but also enhance their sustainability initiatives.