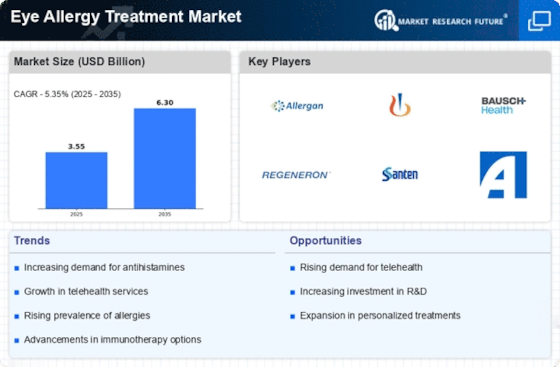

Market Analysis

In-depth Analysis of Eye Allergy Treatment Market Industry Landscape

Government Funding for Eye Health

In many developed and some developing countries, both government and private organizations are actively participating in research and prevention programs focused on eye disorders. These efforts play a crucial role in advancing eye care. The United Kingdom, for example, has made significant strides in this regard. In 2016 alone, the Eye Health Examinations Wales (EHEW) scheme conducted approximately 121,736 eye examinations, demonstrating the commitment to promoting eye health. Furthermore, the National Health Service (NHS) paid for 769,380 general ophthalmic service sight tests in the same year. This substantial support through adequate funding has the potential to significantly boost the growth of the eye care market.

Advancements in Eye Care Products

The continuous progress in treating eye allergies across all age groups is a driving force behind the expansion of the eye care market. Companies like Bausch & Lomb, a subsidiary of Valeant, are at the forefront of these advancements. They are currently developing a new topical corticosteroid called mapracorat, which is undergoing clinical phase II. This ophthalmic solution aims to address issues such as ocular pain, inflammation, eye allergies, and dry eyes. Another player in the field is Merck and Co., offering montelukast, a leukotriene receptor antagonist known for its effectiveness in relieving allergic eye diseases.

Moreover, various manufacturers are actively working on creating innovative ophthalmic solutions, seeking approvals from government regulatory bodies. The heightened competition among existing and emerging market players is fostering an environment conducive to the development of practical and efficient treatments for eye allergies. This competition-driven innovation is a significant factor contributing to the overall growth of the eye care market.

The Importance of Government Support

Favorable government funding is pivotal for the success of research and prevention programs in the field of eye health. This support not only facilitates the exploration of new treatments and diagnostic tools but also ensures that these innovations reach a wider population. In the context of the United Kingdom, the substantial number of eye examinations conducted under the EHEW scheme and the general ophthalmic service sight tests funded by the NHS exemplify the positive impact of government backing.

The Role of Private Organizations

In addition to government support, private organizations play a vital role in advancing eye care. Companies like Bausch & Lomb and Merck and Co. are investing in research and development to bring forth new and improved solutions for various eye conditions. The introduction of mapracorat and montelukast demonstrates the commitment of these organizations to addressing not only common eye problems but also more specific issues like ocular pain and inflammation.

Competition Driving Innovation

The competitive landscape within the eye care market is fostering innovation at an accelerated pace. Manufacturers are not only focused on introducing new products but are also striving to make them more efficient and accessible. This competition-driven innovation benefits consumers by providing a diverse range of treatment options for eye allergies and other conditions.

In conclusion, the combination of favorable government funding, private sector involvement, and competition-driven innovation is propelling the growth of the eye care market. The ongoing advancements in products and treatments not only cater to existing needs but also pave the way for addressing emerging challenges in eye health. The collaborative efforts of governments and private organizations ensure that the future of eye care remains promising and accessible to a wider population.

Leave a Comment