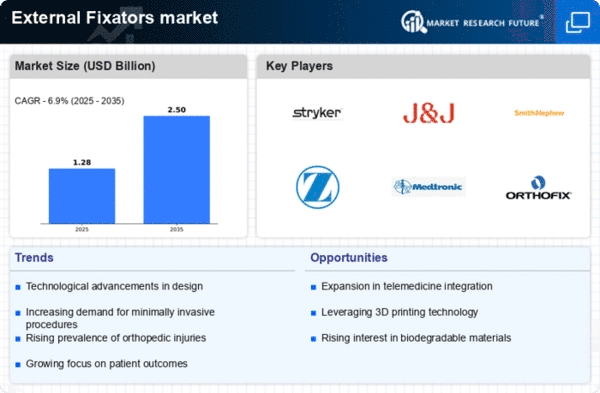

The external fixators Market is characterized by a dynamic competitive landscape, driven by technological advancements, increasing demand for orthopedic procedures, and a growing emphasis on minimally invasive surgical techniques. Key players such as Stryker Corporation (US), DePuy Synthes (US), and Smith & Nephew (GB) are at the forefront, each adopting distinct strategies to enhance their market positioning. Stryker Corporation (US) focuses on innovation, particularly in developing advanced fixation systems that integrate digital technologies, while DePuy Synthes (US) emphasizes strategic partnerships to expand its product offerings and market reach. Smith & Nephew (GB) is actively pursuing regional expansion, particularly in emerging markets, to capitalize on the rising demand for orthopedic solutions. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by technological innovation and strategic collaborations.In terms of business tactics, companies are localizing manufacturing to reduce costs and enhance supply chain efficiency. This approach is particularly relevant in a moderately fragmented market where several players vie for market share. The competitive structure is influenced by the collective actions of these key players, who are increasingly focused on optimizing their supply chains and enhancing product availability to meet the growing demand for external fixators.

In November Stryker Corporation (US) announced the launch of a new line of smart external fixators that utilize AI-driven analytics to monitor patient recovery in real-time. This strategic move is significant as it not only enhances patient outcomes but also positions Stryker as a leader in the integration of technology within orthopedic solutions. The ability to provide real-time data could potentially transform post-operative care and improve overall surgical success rates.

In October DePuy Synthes (US) entered into a partnership with a leading telemedicine provider to enhance remote patient monitoring capabilities for its external fixator products. This collaboration is indicative of a broader trend towards digital health solutions, allowing for improved patient engagement and adherence to treatment protocols. Such initiatives may lead to better clinical outcomes and increased customer loyalty in a competitive market.

In September Smith & Nephew (GB) expanded its manufacturing capabilities in Asia, aiming to meet the rising demand for external fixators in the region. This strategic expansion is crucial as it not only enhances supply chain resilience but also positions the company to better serve a growing customer base in emerging markets. The move reflects a proactive approach to capitalize on regional growth opportunities and mitigate potential supply chain disruptions.

As of December the competitive trends in the external fixators Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, shaping the landscape as companies seek to leverage complementary strengths. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of developing cutting-edge solutions that not only meet clinical needs but also enhance operational efficiencies.