Top Industry Leaders in the Extended Reality Market

Navigating the Dynamic Landscape of Extended Reality

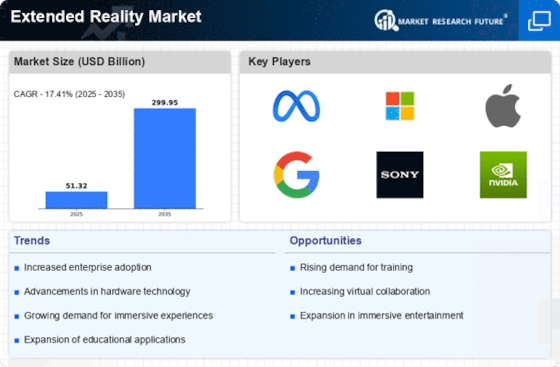

The extended reality (XR) market, encompassing augmented reality (AR), virtual reality (VR), and mixed reality (MR), is witnessing a surge of interest and investment, transforming the way we interact with the world around us. With its potential to revolutionize various industries, from healthcare and education to entertainment and manufacturing, XR has emerged as a hotbed of innovation and competition.

Key Players Shaping the XR Landscape

- Vree

- Talespin

- Qualcomm Incorporated

- Spheregen

- Tata Exlsi

- HP reveal

- Semcon

- GO Find

- Agile lens

- Nothern digital

- Medtronic

- Augray

Strategies for Success in the XR Arena

To thrive in this competitive landscape, companies are employing a variety of strategies, including:

- Hardware Innovation: Ongoing advancements in hardware, such as lighter weight, more powerful processors, and higher resolution displays, are crucial for improving XR experiences.

- Content Creation: A robust ecosystem of compelling content is essential to drive adoption and engagement. Companies are investing in developing and curating AR, VR, and MR experiences across various industries.

- Partnerships and Ecosystem Building: Collaborations between hardware manufacturers, software developers, and content creators are fostering innovation and expanding the XR ecosystem.

- Industry Focus: Targeting specific industries, such as healthcare, education, and manufacturing, allows companies to tailor their solutions to specific needs and gain a competitive edge.

Factors Influencing Market Share

Several factors play a crucial role in determining market share and success in the XR market:

- Hardware Capabilities: The quality and performance of XR headsets and other hardware significantly impact user experience and adoption.

- Content Availability: A wide range of compelling and engaging content is essential to attract and retain users.

- Ease of Use: Simplicity and intuitiveness of XR devices and software are key for mass adoption.

- Pricing: Competitive pricing strategies are crucial to attract a larger customer base.

Emerging Companies Poised for Growth

Alongside established players, a number of emerging companies are rapidly gaining traction in the XR market, bringing fresh ideas and innovation to the sector:

- Snap Inc.: Known for its Snapchat platform, Snap is developing AR lenses that integrate with the real world, offering unique interactive experiences.

- Qualcomm: The chipmaker is a major player in XR hardware, providing advanced processors that power many VR and AR headsets.

- Unity Technologies: The leading game development platform is expanding its XR capabilities, enabling developers to create immersive experiences across various industries.

- Epic Games: The creator of the popular game Fortnite is also investing in XR, developing tools and technologies for creating engaging and interactive experiences.

Investment Trends Shaping the XR Future

The XR market is attracting significant investments from venture capitalists and corporations alike, fueling innovation and driving growth:

- Venture Capital: XR startups are receiving substantial funding from venture capitalists, supporting the development of groundbreaking technologies and applications.

- Corporate Investments: Major corporations, including Google, Samsung, and Sony, are investing in XR, leveraging their expertise and resources to gain a competitive edge.

- Government Initiatives: Governments worldwide are supporting XR development, recognizing its potential to transform various sectors.

Updated News

January 8, 2024:

- Apple Vision Pro Headset Launching in February: The highly anticipated Apple Vision Pro headset is expected to arrive in February, bringing advanced mixed reality capabilities to consumers.

- Independent VR Studio Archiact Lays Off Employees: Archiact, a prominent independent VR studio, has announced layoffs amid industry challenges and shifting market dynamics.

January 10, 2024:

- Hasbro Expands Digital Games Portfolio Amid Layoffs: Hasbro, the iconic toy company, is reportedly expanding its digital games portfolio despite ongoing layoffs and restructuring efforts.

January 24, 2024:

- Meta Optimistic about Apple's Entry into XR Market: Meta, formerly Facebook, expresses optimism about Apple's foray into the XR market, believing it will drive overall industry growth.

February 2, 2024:

- Zoom Debuts on Apple Vision Pro Headset: Zoom, the popular video conferencing platform, officially launches on the Apple Vision Pro headset, enhancing remote collaboration and communication experiences.

- XREAL Secures $60 Million to Compete with Apple Vision Pro: XREAL, an AR company, secures a $60 million investment to develop its AR headset, aiming to challenge Apple's Vision Pro in the mixed reality space.