Emergence of Big Data Analytics

The proliferation of big data is a key driver of the Exascale Computing Market. Organizations across various sectors are increasingly generating and collecting vast amounts of data, necessitating advanced computing solutions to analyze and derive insights from this information. The ability to process and analyze big data efficiently is becoming a competitive differentiator for businesses. As a result, the demand for exascale computing systems, which can handle large-scale data processing tasks, is expected to grow. Market Research Future indicates that the big data analytics market could reach 274 billion USD by 2022, highlighting the urgency for organizations to invest in exascale computing technologies to remain competitive in a data-driven landscape.

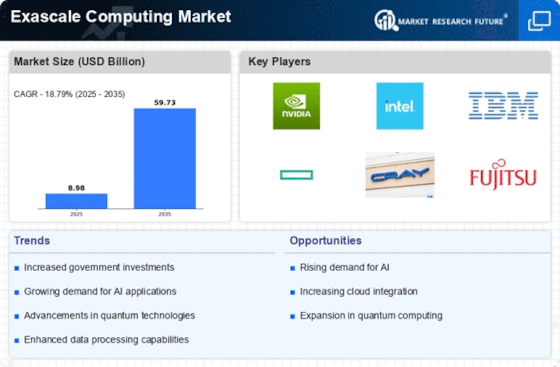

Government Initiatives and Funding

Government initiatives and funding programs are playing a crucial role in shaping the Exascale Computing Market. Various governments are recognizing the strategic importance of exascale computing for national security, scientific research, and technological advancement. For instance, significant investments have been made in supercomputing facilities and research programs aimed at developing exascale systems. In the United States, the Department of Energy has allocated billions of dollars to support exascale computing projects, which are expected to enhance the country's computational capabilities. Such government backing not only stimulates innovation but also encourages collaboration between public and private sectors, thereby fostering a conducive environment for growth in the exascale computing domain.

Rising Demand for High-Performance Computing

The Exascale Computing Market is experiencing a notable surge in demand for high-performance computing (HPC) solutions. This demand is primarily driven by the need for advanced data processing capabilities across various sectors, including scientific research, healthcare, and finance. As organizations increasingly rely on data-intensive applications, the requirement for faster and more efficient computing systems becomes paramount. According to recent estimates, the HPC market is projected to reach approximately 50 billion USD by 2026, indicating a robust growth trajectory. This trend suggests that investments in exascale computing technologies will likely accelerate, as organizations seek to enhance their computational power to tackle complex problems and derive actionable insights from vast datasets.

Growing Need for Enhanced Cybersecurity Measures

As cyber threats continue to evolve, the Exascale Computing Market is witnessing a growing emphasis on enhanced cybersecurity measures. Organizations are increasingly aware of the potential risks associated with data breaches and cyberattacks, prompting them to invest in robust computing solutions that can support advanced security protocols. Exascale computing systems offer the computational power necessary to implement sophisticated encryption techniques and real-time threat detection algorithms. This trend is particularly relevant in sectors such as finance, healthcare, and government, where data integrity and security are paramount. The increasing focus on cybersecurity is likely to drive demand for exascale computing technologies, as organizations seek to protect sensitive information and maintain operational resilience.

Advancements in Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the Exascale Computing Market. These advancements necessitate the development of more powerful computing systems capable of processing large volumes of data at unprecedented speeds. As AI and ML applications become increasingly prevalent in sectors such as autonomous vehicles, predictive analytics, and personalized medicine, the demand for exascale computing solutions is expected to rise. Industry analysts project that the AI market alone could reach 190 billion USD by 2025, further underscoring the need for enhanced computational capabilities. Consequently, the exascale computing sector is likely to witness substantial growth as organizations strive to leverage AI and ML for competitive advantage.