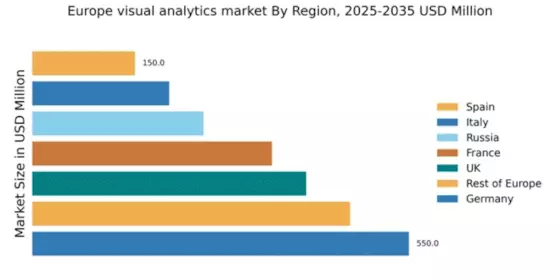

Germany : Strong Demand and Innovation Drive Growth

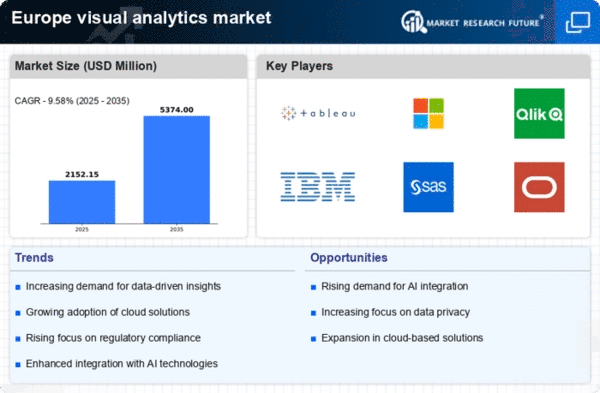

Key markets include major cities like Berlin, Munich, and Frankfurt, which are home to numerous tech startups and established enterprises. The competitive landscape features significant players such as Tableau, Microsoft, and Qlik, all vying for market share. The business environment is characterized by a strong focus on R&D and collaboration between academia and industry. Sectors like finance, healthcare, and manufacturing are increasingly adopting visual analytics solutions to enhance operational efficiency and customer insights.

UK : Innovation and Investment Drive Demand

Key markets include London, Manchester, and Edinburgh, where a vibrant tech ecosystem thrives. Major players like IBM and SAS have a strong presence, fostering competition and innovation. The local market dynamics are influenced by a collaborative environment among startups and established firms. Industries such as e-commerce and telecommunications are leveraging visual analytics to enhance customer engagement and operational efficiency.

France : Strong Growth in Diverse Sectors

Key markets include Paris, Lyon, and Marseille, where numerous tech companies and startups are emerging. The competitive landscape features major players like Oracle and Qlik, which are actively expanding their offerings. The business environment is characterized by a focus on innovation and collaboration, with local firms increasingly adopting analytics to improve operational efficiency and customer insights. The French government is also promoting data-driven initiatives to enhance competitiveness.

Russia : Market Expansion Amid Challenges

Key markets include Moscow and St. Petersburg, where a burgeoning tech scene is fostering innovation. Major players like Microsoft and IBM are establishing a presence, contributing to a competitive landscape. The local market dynamics are influenced by a mix of state-owned enterprises and private firms, with a focus on enhancing operational efficiency through analytics. Industries such as energy and finance are increasingly adopting visual analytics to drive growth and improve decision-making processes.

Italy : Focus on Innovation and Adoption

Key markets include Milan, Rome, and Turin, where a mix of traditional industries and tech startups are driving demand. The competitive landscape features players like Tableau and SAS, which are expanding their offerings to cater to local needs. The business environment is characterized by a growing emphasis on data-driven strategies, with industries such as fashion and automotive leveraging analytics to enhance operational efficiency and customer engagement.

Spain : Growth Driven by Digital Transformation

Key markets include Madrid and Barcelona, where a vibrant tech ecosystem is emerging. Major players like Qlik and Oracle are establishing a presence, contributing to a competitive landscape. The local market dynamics are influenced by a mix of startups and established firms, with industries such as tourism and retail increasingly adopting visual analytics to enhance customer experiences and operational efficiency. The focus on data-driven decision-making is reshaping the business environment.

Rest of Europe : Growth Across Multiple Markets

Key markets include cities across Scandinavia, the Benelux region, and Eastern Europe, where a mix of established firms and startups are driving demand. The competitive landscape features major players like IBM and Microsoft, which are expanding their offerings to cater to local needs. Local market dynamics are characterized by a focus on innovation and collaboration, with industries such as healthcare and finance leveraging visual analytics to improve decision-making and operational efficiency.