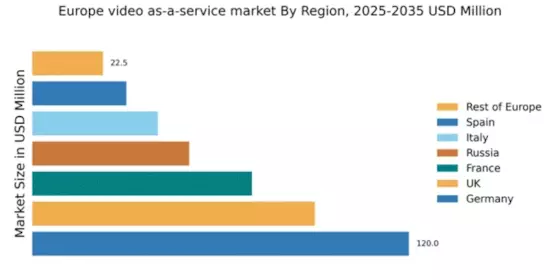

Germany : Strong Demand and Infrastructure Growth

Germany holds a commanding market share of 120.0, representing a significant portion of the European video as-a-service market. Key growth drivers include a robust digital infrastructure, increasing demand for streaming services, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing broadband access and fostering innovation in the tech sector, which further fuels consumption patterns favoring video content.

UK : Innovation and Consumer Engagement

The UK video as-a-service market is valued at 90.0, driven by a tech-savvy population and high internet penetration. Growth is propelled by increasing demand for on-demand content and live streaming services. Regulatory frameworks are evolving to address data privacy and content standards, while government initiatives support digital skills training. The competitive landscape is vibrant, with numerous startups and established players vying for market share, reflecting a diverse consumption pattern.

France : Cultural Richness Drives Demand

France's market, valued at 70.0, is characterized by a strong cultural emphasis on audiovisual content. Growth is driven by increasing mobile consumption and government support for creative industries. Regulatory policies encourage local content production, enhancing demand for video services. The market is concentrated in urban areas like Paris and Lyon, where major players like Orange and Canal+ dominate, creating a competitive yet collaborative environment for innovation.

Russia : Expanding Digital Infrastructure

With a market value of 50.0, Russia's video as-a-service sector is on the rise, driven by expanding internet access and a growing middle class. Demand for localized content is increasing, supported by government initiatives aimed at boosting the digital economy. Key cities like Moscow and St. Petersburg are central to market activities, with local players like Yandex and VK competing alongside international giants, creating a dynamic business environment.

Italy : Diverse Market with Unique Needs

Italy's video as-a-service market, valued at 40.0, is influenced by its rich cultural heritage and diverse consumer preferences. Growth drivers include increasing mobile usage and a shift towards subscription-based models. Regulatory support for local content production enhances market appeal. Key cities such as Milan and Rome are pivotal, with major players like Mediaset and Sky Italia leading the charge, fostering a competitive landscape that caters to varied audience tastes.

Spain : Youth Engagement and Innovation

Spain's market, valued at 30.0, is characterized by a youthful demographic increasingly engaged in video consumption. Growth is driven by mobile streaming and social media integration. Regulatory frameworks are adapting to support digital content creators and protect consumer rights. Major cities like Madrid and Barcelona are key markets, with local players like Movistar and international firms like Netflix competing, creating a vibrant and competitive environment.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe, with a market value of 22.5, showcases diverse video as-a-service landscapes influenced by local cultures and economic conditions. Growth drivers vary, with some regions focusing on mobile access while others emphasize content localization. Regulatory environments differ significantly, impacting market dynamics. Countries like Belgium and the Netherlands are notable, with local players and international firms navigating unique challenges and opportunities in their respective markets.