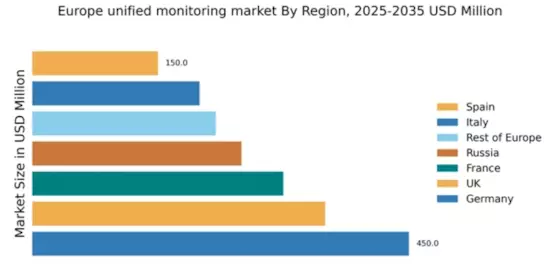

Germany : Strong Demand and Innovation Hub

Germany holds a commanding market share of 30% in the unified monitoring sector, valued at €450.0 million. Key growth drivers include a robust IT infrastructure, increasing digital transformation initiatives, and a strong focus on data security regulations. The demand for real-time monitoring solutions is surging, driven by the rise of cloud computing and IoT applications. Government initiatives promoting digitalization further bolster market growth, alongside significant investments in industrial automation and smart technologies.

UK : Tech-Driven Market Expansion

The UK market accounts for 25% of the European unified monitoring sector, valued at €350.0 million. Growth is fueled by the rapid adoption of cloud services and a shift towards remote work, increasing the need for effective monitoring solutions. Regulatory frameworks, such as GDPR, drive demand for compliance-focused tools. The UK government’s investment in tech startups also enhances innovation in this space, fostering a competitive environment.

France : Innovation and Compliance Drive Growth

France represents 20% of the unified monitoring market in Europe, valued at €300.0 million. The growth is propelled by the increasing need for compliance with data protection laws and the rise of digital services. Demand for monitoring solutions is particularly strong in sectors like finance and healthcare, where data integrity is critical. Government initiatives supporting digital innovation and cybersecurity are also significant growth factors.

Russia : Growth Amidst Regulatory Challenges

Russia holds a 17% share of the unified monitoring market, valued at €250.0 million. The market is driven by increasing investments in IT infrastructure and a growing emphasis on cybersecurity. However, regulatory challenges and geopolitical factors can impact growth. Demand is particularly strong in major cities like Moscow and St. Petersburg, where tech adoption is accelerating, despite a complex business environment.

Italy : Focus on Digital Transformation

Italy accounts for 13% of the unified monitoring market, valued at €200.0 million. The growth is driven by the increasing adoption of cloud technologies and a focus on enhancing operational efficiency. Regulatory support for digital transformation initiatives is also a key factor. The competitive landscape includes both local and international players, with significant activity in cities like Milan and Rome, where tech innovation is thriving.

Spain : Tech Adoption Fuels Market Growth

Spain represents 10% of the unified monitoring market, valued at €150.0 million. The market is experiencing growth due to the rising adoption of digital technologies and cloud services. Government initiatives aimed at boosting the digital economy are also contributing to market expansion. Key cities like Madrid and Barcelona are central to this growth, with a competitive landscape featuring both local and international firms.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe accounts for 15% of the unified monitoring market, valued at €219.23 million. This sub-region includes a mix of developed and emerging markets, each with unique growth drivers. Demand trends vary significantly, influenced by local regulations and market maturity. Countries like the Netherlands and the Nordics are leading in tech adoption, while Eastern European nations are catching up, driven by increasing investments in IT infrastructure.

Leave a Comment