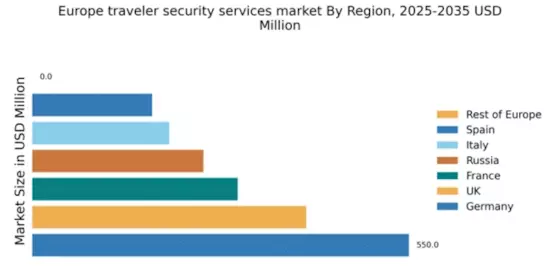

Germany : Robust Growth in Traveler Security

Germany holds a dominant position in the European traveler security-services market, accounting for 550.0 million, representing approximately 36.7% of the total market share. Key growth drivers include increasing travel activity, heightened security concerns, and government initiatives aimed at enhancing public safety. Regulatory policies are becoming more stringent, promoting compliance among service providers. Infrastructure development, particularly in transportation hubs like Frankfurt and Berlin, further supports market expansion.

UK : Evolving Landscape of Traveler Safety

The UK market for traveler security services is valued at 400.0 million, representing about 26.7% of the European market. Growth is driven by rising international travel and a focus on risk management in the wake of recent global events. Demand trends indicate a shift towards integrated security solutions, with an emphasis on technology. The UK government has implemented various initiatives to bolster security measures, particularly in major cities like London and Manchester, enhancing the overall business environment.

France : Focus on Comprehensive Safety Solutions

France's traveler security-services market is valued at 300.0 million, capturing 20% of the European market. The growth is fueled by increasing tourism and a proactive approach to security, especially in urban areas like Paris. Demand for personalized security services is on the rise, driven by both corporate and leisure travelers. Regulatory frameworks are evolving, with the government promoting safety standards across the industry, which is crucial for maintaining public trust and safety.

Russia : Growing Demand Amidst Challenges

Russia's traveler security-services market is valued at 250.0 million, accounting for 16.7% of the European market. Key growth drivers include an increase in domestic and international travel, alongside a focus on enhancing security measures in major cities like Moscow and St. Petersburg. The competitive landscape features both local and international players, with a growing emphasis on technology-driven solutions. Government initiatives are aimed at improving safety standards, although challenges remain in regulatory compliance.

Italy : Tourism-Driven Security Demand

Italy's market for traveler security services is valued at 200.0 million, representing 13.3% of the European market. The growth is primarily driven by the tourism sector, with cities like Rome and Milan being key markets. Demand for security services is evolving, with a focus on tailored solutions for both tourists and business travelers. The competitive landscape includes major players and local firms, while government initiatives are enhancing safety protocols, contributing to a more secure travel environment.

Spain : Tourism Fuels Security Growth

Spain's traveler security-services market is valued at 175.0 million, making up 11.7% of the European market. The growth is largely driven by the booming tourism industry, particularly in cities like Barcelona and Madrid. Demand trends indicate a preference for comprehensive security solutions that cater to diverse traveler needs. The competitive landscape features both international and local players, while government initiatives are focused on improving safety standards, enhancing the overall market environment.

Rest of Europe : Emerging Markets Await Development

The Rest of Europe currently shows no significant market value in traveler security services, indicating untapped potential across various countries. Growth drivers include increasing travel and tourism, alongside a rising awareness of security needs. Regulatory frameworks are still developing, with many countries looking to enhance their security measures. Infrastructure improvements are essential for fostering a conducive environment for security service providers, paving the way for future market growth.