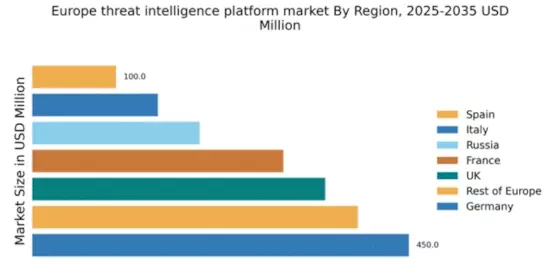

Germany : Robust Growth and Innovation Hub

Germany holds a dominant position in the European threat intelligence-platform market, accounting for 450.0 million, representing approximately 30% of the total market share. Key growth drivers include a strong emphasis on cybersecurity regulations, such as the IT Security Act, and increasing investments in digital infrastructure. The demand for advanced threat detection and response solutions is rising, driven by the growing number of cyber threats and the need for compliance with stringent data protection laws.

UK : Innovation and Investment in Cybersecurity

The UK threat intelligence-platform market is valued at 350.0 million, capturing about 23% of the European market. Growth is fueled by increasing cyber threats and government initiatives like the National Cyber Security Strategy, which promotes public-private partnerships. The demand for real-time threat intelligence is surging, particularly in finance and healthcare sectors, as organizations seek to enhance their security postures against evolving threats.

France : Strong Regulatory Support and Growth

France's market for threat intelligence platforms is valued at 300.0 million, representing roughly 20% of the European market. The growth is driven by the French government's commitment to cybersecurity, highlighted by the Cybersecurity Strategy 2021-2025. Demand is increasing for solutions that comply with GDPR and protect sensitive data, particularly in sectors like finance and telecommunications, where data breaches can have severe consequences.

Russia : Focus on National Security Initiatives

Russia's threat intelligence-platform market is valued at 200.0 million, accounting for about 13% of the European market. Key growth drivers include national security initiatives and increasing cyber threats from both domestic and international actors. The demand for localized solutions is rising, particularly in government and defense sectors, as organizations seek to bolster their cybersecurity frameworks against espionage and cyber warfare.

Italy : Investment in Digital Transformation

Italy's market for threat intelligence platforms is valued at 150.0 million, representing about 10% of the European market. Growth is driven by increasing awareness of cybersecurity risks and government initiatives like the National Cybersecurity Strategy. Demand is particularly strong in sectors such as manufacturing and finance, where digital transformation is accelerating and necessitating robust cybersecurity measures to protect sensitive information.

Spain : Focus on Cyber Resilience Strategies

Spain's threat intelligence-platform market is valued at 100.0 million, capturing around 7% of the European market. The growth is supported by government initiatives aimed at enhancing national cybersecurity resilience, including the National Cybersecurity Strategy. Demand is increasing in sectors like tourism and finance, where organizations are prioritizing cybersecurity to protect customer data and maintain trust in digital services.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe market for threat intelligence platforms is valued at 389.0 million, accounting for about 26% of the European market. Growth drivers vary by country, influenced by local regulations and cybersecurity threats. Demand is rising for tailored solutions that address specific regional challenges, particularly in sectors like healthcare and energy, where data protection is critical. The competitive landscape includes both local and international players, adapting to diverse market needs.