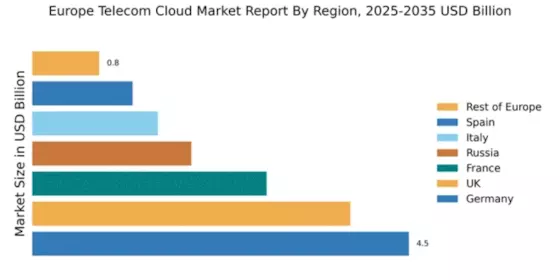

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding 4.5% market share in the telecom cloud sector, valued at approximately €1.5 billion. Key growth drivers include robust industrial automation, a strong emphasis on data privacy regulations, and government initiatives promoting digital transformation. The demand for cloud services is surging, particularly in sectors like automotive and manufacturing, where efficiency and scalability are paramount. The German government has also introduced policies to enhance broadband infrastructure, facilitating greater cloud adoption.

UK : Innovation and Investment Drive Market

The UK telecom cloud market accounts for 3.8% of the European share, valued at around €1.2 billion. Growth is fueled by increasing demand for remote work solutions and digital services, particularly in finance and healthcare. The UK government has implemented favorable regulations to encourage cloud adoption, including tax incentives for tech startups. The competitive landscape is vibrant, with London emerging as a key hub for cloud service providers, fostering innovation and collaboration.

France : Strong Demand in Diverse Sectors

France captures a 2.8% market share in the telecom cloud sector, valued at approximately €900 million. The growth is driven by the increasing digitalization of businesses and government initiatives aimed at enhancing cybersecurity. Demand is particularly strong in sectors like retail and public services, where cloud solutions are being integrated for better efficiency. The French government is actively promoting cloud adoption through its 'France Num' initiative, which supports SMEs in their digital transformation.

Russia : Investment and Infrastructure Development

Russia's telecom cloud market holds a 1.9% share, valued at about €600 million. Key growth drivers include significant investments in IT infrastructure and a rising demand for cloud services in sectors like telecommunications and e-commerce. The Russian government has introduced regulations to support local cloud providers, enhancing competition. Major cities like Moscow and St. Petersburg are pivotal markets, with local players like Yandex Cloud gaining traction against international competitors.

Italy : Focus on Digital Transformation Initiatives

Italy's telecom cloud market represents 1.5% of the European share, valued at approximately €500 million. Growth is propelled by government initiatives aimed at digital transformation, particularly in the public sector. The demand for cloud services is increasing in industries such as manufacturing and tourism, where efficiency is crucial. The Italian government has launched programs to enhance broadband connectivity, facilitating greater cloud adoption across the country.

Spain : Innovation and Collaboration in Focus

Spain accounts for 1.2% of the telecom cloud market in Europe, valued at around €400 million. The growth is driven by increasing investments in digital infrastructure and a rising demand for cloud solutions in sectors like tourism and finance. The Spanish government has introduced initiatives to promote cloud adoption among SMEs, enhancing the competitive landscape. Cities like Madrid and Barcelona are key markets, with major players like Telefonica leading the charge in cloud services.

Rest of Europe : Emerging Markets and Innovations

The Rest of Europe holds a 0.8% market share in the telecom cloud sector, valued at approximately €250 million. Growth is driven by emerging markets in Eastern Europe, where digital transformation is gaining momentum. Regulatory frameworks are evolving to support cloud adoption, with various governments promoting local providers. Countries like Poland and the Czech Republic are seeing increased investments in cloud infrastructure, creating opportunities for both local and international players.