Growing Emphasis on Marketing Automation

the tag management software market in Europe is seeing a growing emphasis on marketing automation, which is reshaping how businesses approach their digital strategies. As organizations strive to optimize their marketing efforts, the integration of tag management solutions with automation tools becomes increasingly vital. This integration allows for the seamless collection and analysis of data, enabling marketers to make informed decisions in real-time. Recent market analysis indicates that the marketing automation sector is expected to grow by approximately 20% annually, which in turn drives the demand for effective tag management solutions. By automating tag deployment and management, businesses can enhance their operational efficiency and improve campaign performance. This trend suggests that the tag management-software market will continue to evolve in response to the increasing need for automation in marketing processes.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming critical drivers for the tag management-software market in Europe. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), businesses are compelled to adopt solutions that ensure compliance. Tag management software plays a crucial role in helping organizations manage user consent and data collection practices effectively. The market is likely to see a rise in demand for solutions that offer robust compliance features, as companies seek to mitigate risks associated with data breaches and non-compliance penalties. It is estimated that the compliance-related segment of the tag management-software market could grow by 25% over the next few years, reflecting the increasing importance of data governance in digital marketing strategies. This trend underscores the necessity for businesses to prioritize compliance in their tag management efforts.

Rising Demand for Enhanced User Experience

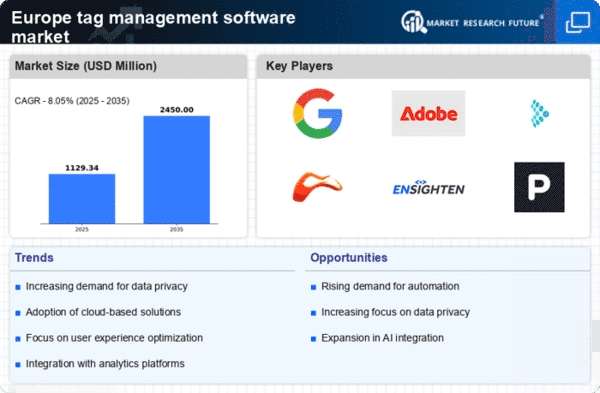

the tag management software market in Europe is seeing a notable surge in demand. As businesses increasingly recognize the importance of delivering personalized and seamless interactions, the need for effective tag management becomes paramount. This software enables organizations to deploy and manage tags efficiently, ensuring that user data is utilized to create tailored experiences. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the necessity for improved customer engagement. Companies are investing in tag management solutions to streamline their marketing efforts, thereby enhancing conversion rates and customer satisfaction. This trend indicates a shift towards prioritizing user-centric strategies, which is likely to further propel the growth of the tag management-software market in Europe.

Increased Adoption of Cloud-Based Solutions

The transition towards cloud-based solutions is significantly influencing the tag management-software market in Europe. Organizations are increasingly adopting cloud technologies to enhance scalability, flexibility, and cost-effectiveness. Cloud-based tag management systems allow businesses to manage their tags without the need for extensive on-premises infrastructure, which can be both costly and complex. This shift is reflected in the market data, which suggests that cloud-based solutions are expected to account for over 60% of the total market share by 2026. The ability to access and manage tags from anywhere, coupled with the reduced IT overhead, makes cloud solutions particularly appealing to European enterprises. As more companies recognize the benefits of cloud adoption, the demand for tag management software is likely to continue its upward trajectory, further solidifying its role in digital marketing strategies.

Emergence of Advanced Analytics Capabilities

The emergence of advanced analytics capabilities is significantly impacting the tag management-software market in Europe. As businesses seek to derive actionable insights from their data, the integration of advanced analytics tools with tag management solutions is becoming increasingly prevalent. This integration allows organizations to track user behavior more effectively and optimize their marketing strategies accordingly. Market forecasts suggest that the analytics segment within the tag management-software market could experience growth rates of around 18% annually, driven by the demand for data-driven decision-making. By leveraging advanced analytics, companies can enhance their understanding of customer journeys and improve their targeting efforts. This trend indicates a shift towards more sophisticated data utilization, which is likely to further propel the growth of the tag management-software market in Europe.