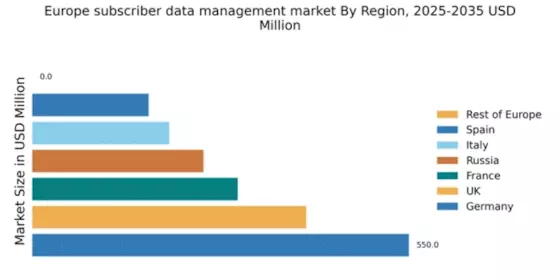

Germany : Strong Growth and Innovation Hub

Germany holds a dominant position in the European subscriber data-management market, with a market value of $550.0 million, representing approximately 36.7% of the total market share. Key growth drivers include a robust digital economy, increasing data privacy regulations, and a strong emphasis on data-driven decision-making. The government has initiated several policies to enhance digital infrastructure, fostering innovation and attracting investments in technology sectors.

UK : Innovation Meets Regulatory Challenges

The UK market for subscriber data management is valued at $400.0 million, accounting for about 26.7% of the European market. Growth is driven by the rise of e-commerce and digital marketing, alongside stringent data protection laws like GDPR. The UK government supports digital transformation initiatives, enhancing the infrastructure for data management solutions. Demand for personalized customer experiences is also on the rise, influencing consumption patterns.

France : Focus on Compliance and Innovation

France's subscriber data management market is valued at $300.0 million, representing 20% of the European market. The growth is fueled by increasing digitalization across sectors and a strong regulatory framework emphasizing data privacy. The French government has launched initiatives to support tech startups, enhancing the local ecosystem. Demand for data analytics and customer insights is growing, particularly in retail and finance sectors.

Russia : Market Growth Amid Challenges

Russia's subscriber data management market is valued at $250.0 million, making up 16.7% of the European market. Key growth drivers include the increasing adoption of digital technologies and government initiatives aimed at enhancing data security. However, regulatory challenges and geopolitical factors may impact market dynamics. The demand for data-driven solutions is rising, particularly in sectors like telecommunications and e-commerce.

Italy : Cultural Shift Towards Digitalization

Italy's subscriber data management market is valued at $200.0 million, representing 13.3% of the European market. Growth is driven by a cultural shift towards digitalization and increasing investments in technology. The Italian government is promoting digital transformation through various initiatives, enhancing the infrastructure for data management. Demand for data analytics is particularly strong in the fashion and automotive industries.

Spain : Innovation in a Competitive Market

Spain's subscriber data management market is valued at $170.0 million, accounting for 11.3% of the European market. The growth is driven by the increasing use of digital marketing and e-commerce, alongside supportive government policies for tech innovation. Major cities like Madrid and Barcelona are key markets, fostering a competitive landscape with both local and international players. Demand for data-driven insights is particularly strong in tourism and retail sectors.

Rest of Europe : Emerging Markets Await Development

The Rest of Europe shows a nascent subscriber data management market with no significant value reported. However, there is potential for growth as digital transformation initiatives gain traction across various countries. Regulatory frameworks are evolving, and government support for technology adoption is increasing. As infrastructure improves, demand for data management solutions is expected to rise, particularly in Eastern European countries.