Germany : Strong Growth and Innovation Hub

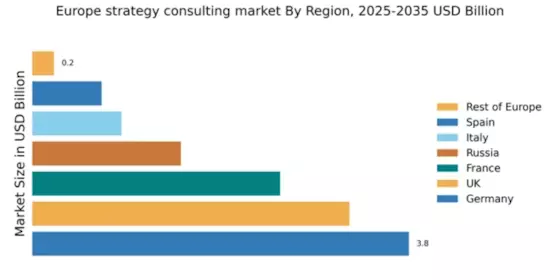

Germany holds a commanding 3.8% market share in the European strategy consulting sector, valued at approximately €12 billion. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and a strong emphasis on sustainability. Demand trends show a rising need for strategic guidance in technology adoption and operational efficiency. Government initiatives promoting innovation and investment in infrastructure further bolster market growth.

UK : Innovation and Diversity Drive Growth

The UK strategy consulting market accounts for 3.2% of the European total, valued at around €10 billion. Growth is fueled by a diverse economy, with strong demand in financial services, healthcare, and technology sectors. Regulatory frameworks supporting innovation and a skilled workforce contribute to a favorable business environment. The shift towards remote consulting services has also reshaped consumption patterns, increasing accessibility for clients.

France : Strong Demand in Key Sectors

France captures a 2.5% share of the European strategy consulting market, valued at approximately €7.5 billion. Growth drivers include a focus on digital transformation, sustainability, and regulatory compliance. The French government has initiated several programs to support innovation and entrepreneurship, enhancing the consulting landscape. Demand is particularly strong in sectors like automotive, aerospace, and luxury goods.

Russia : Growth Amidst Economic Challenges

Russia's strategy consulting market holds a 1.5% share, valued at about €4.5 billion. Key growth drivers include the need for modernization in various industries and government initiatives aimed at economic diversification. Demand trends indicate a rising interest in digital solutions and operational efficiency. However, regulatory challenges and geopolitical factors pose risks to market stability.

Italy : Focus on Innovation and Growth

Italy represents a 0.9% share of the European strategy consulting market, valued at approximately €2.7 billion. Growth is driven by a resurgence in manufacturing and a push towards digital transformation. Government initiatives aimed at supporting SMEs and innovation are crucial for market expansion. Demand is particularly strong in fashion, automotive, and food sectors, reflecting Italy's diverse industrial landscape.

Spain : Resilience in Economic Recovery

Spain's strategy consulting market accounts for 0.7% of the European total, valued at around €2.1 billion. Key growth drivers include economic recovery post-pandemic and increased investment in technology and sustainability. The Spanish government has launched initiatives to support digitalization across sectors, enhancing demand for consulting services. Key markets include Madrid and Barcelona, where major players are increasingly active.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe holds a 0.22% share of the strategy consulting market, valued at approximately €660 million. Growth drivers vary significantly across countries, influenced by local economic conditions and regulatory environments. Demand trends show a rising interest in consulting services related to digital transformation and sustainability. The competitive landscape includes both local firms and international players, adapting to diverse market needs.