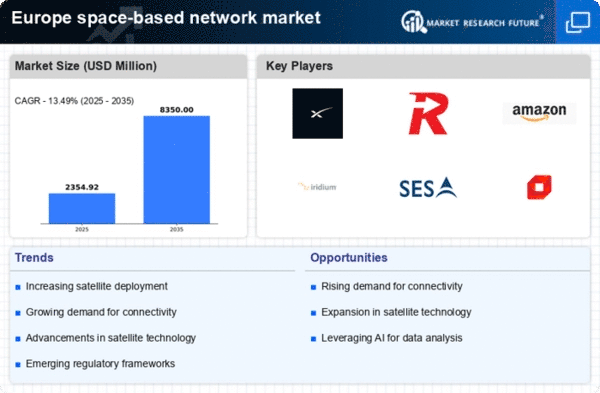

Growing Demand for Connectivity

The demand for enhanced connectivity across Europe is a primary driver of the space-based network market. With the increasing reliance on digital services, there is a pressing need for robust communication infrastructure. As of 2025, it is estimated that over 80% of European households have access to the internet, with a significant portion relying on satellite-based solutions for connectivity in rural and remote areas. This trend is likely to continue, as governments and private entities invest in expanding broadband access. The European Commission has set ambitious targets to ensure that all citizens have access to high-speed internet by 2030, further propelling the growth of the space based-network market in the region.

Regulatory Support and Frameworks

The regulatory environment in Europe is evolving to support the growth of the space-based network market. The European Space Agency (ESA) and the European Union are actively developing frameworks that facilitate satellite launches and operations. Recent initiatives aim to streamline licensing processes and reduce bureaucratic hurdles, which could potentially accelerate market entry for new players. Additionally, the European Union's Space Programme, with a budget of €14.88 billion for 2021-2027, emphasizes the importance of satellite communications and navigation systems. This regulatory support is likely to enhance investment opportunities and foster innovation within the space based-network market in Europe.

Emerging Applications and Use Cases

The emergence of new applications and use cases is driving the evolution of the space-based network market in Europe. Industries such as agriculture, healthcare, and transportation are increasingly leveraging satellite technology for data collection and analysis. For instance, precision agriculture is utilizing satellite imagery to optimize crop yields, while telemedicine is expanding access to healthcare in remote areas. As of 2025, it is estimated that the market for satellite-based applications will grow by 25%, indicating a robust demand for innovative solutions. This diversification of applications is likely to attract new players and investments, further propelling the growth of the space based-network market in Europe.

Advancements in Satellite Technology

The space-based network market in Europe is experiencing a surge due to rapid advancements in satellite technology. Innovations in miniaturization and propulsion systems have led to the deployment of smaller, more efficient satellites. This has resulted in a reduction of launch costs, making it feasible for new entrants to participate in the market. As of 2025, the average cost of launching a satellite has decreased by approximately 30%, fostering a competitive landscape. Furthermore, enhanced communication capabilities are enabling higher data transmission rates, which are crucial for applications such as IoT and remote sensing. The integration of artificial intelligence in satellite operations is also streamlining processes, thereby increasing the overall efficiency of the space based-network market in Europe.

Increased Investment in Space Infrastructure

Investment in space infrastructure is a critical driver for the space-based network market in Europe. Public and private sectors are recognizing the strategic importance of space capabilities, leading to increased funding for satellite projects. In 2025, it is projected that investment in European space ventures will exceed €10 billion, reflecting a growing commitment to developing advanced satellite systems. This influx of capital is expected to support the construction of new ground stations and satellite networks, enhancing overall service delivery. Furthermore, partnerships between governments and private companies are likely to catalyze innovation, thereby strengthening the competitive position of the space based-network market in Europe.