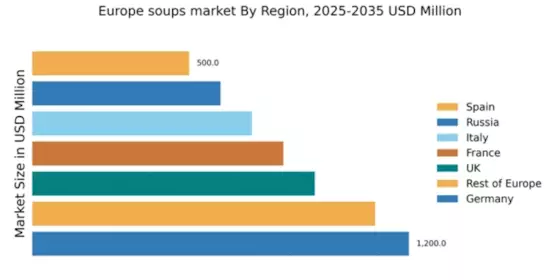

Germany : Strong Demand and Diverse Offerings

Germany holds a significant market share of 24% in the European soup market, valued at $1,200.0 million. Key growth drivers include a rising preference for convenient meal options and an increasing focus on health and wellness. Demand trends show a shift towards organic and plant-based soups, supported by government initiatives promoting healthy eating. The country benefits from robust infrastructure and a well-established food processing industry, facilitating efficient distribution and production.

UK : Health Trends Shape Consumer Choices

The UK soup market accounts for 18% of the European total, valued at $900.0 million. Growth is driven by increasing health consciousness among consumers, leading to a surge in demand for low-sodium and organic options. Regulatory policies encourage transparency in labeling, enhancing consumer trust. The market is characterized by a diverse range of products, from ready-to-eat soups to gourmet offerings, catering to various consumer preferences.

France : Rich Flavors and Varied Choices

France represents 16% of the European soup market, valued at $800.0 million. The growth is fueled by a strong culinary tradition and a rising interest in gourmet and artisanal soups. Demand for locally sourced ingredients is increasing, supported by government initiatives promoting regional products. The market is characterized by a blend of traditional recipes and modern flavors, appealing to both local and international consumers.

Russia : Growing Demand for Convenience Foods

Russia holds a 12% share of the European soup market, valued at $600.0 million. Key growth drivers include urbanization and a busy lifestyle, leading to increased demand for convenient meal solutions. Regulatory policies are evolving to support food safety and quality standards. The market is witnessing a rise in ready-to-eat soups, particularly in urban centers like Moscow and St. Petersburg, where consumer preferences are shifting towards convenience.

Italy : Rich Flavors and Local Ingredients

Italy accounts for 14% of the European soup market, valued at $700.0 million. The growth is driven by a strong preference for traditional recipes and high-quality ingredients. Demand for organic and locally sourced soups is on the rise, supported by government initiatives promoting sustainable agriculture. The competitive landscape features both local artisans and international brands, with cities like Milan and Rome being key markets.

Spain : Cultural Diversity Drives Demand

Spain represents 10% of the European soup market, valued at $500.0 million. The growth is driven by a rich culinary culture and increasing interest in healthy eating. Demand for traditional Spanish soups, such as gazpacho, is complemented by a rise in ready-to-eat options. Regulatory policies are focusing on food safety and quality, enhancing consumer confidence. Key markets include Barcelona and Madrid, where diverse offerings cater to various tastes.

Rest of Europe : Varied Tastes Across Regions

The Rest of Europe accounts for 22% of the soup market, valued at $1,092.5 million. Growth is driven by diverse consumer preferences and increasing health awareness. Regulatory frameworks vary by country, impacting product offerings and marketing strategies. The competitive landscape includes both local and international players, with key markets in Scandinavia and Eastern Europe, where traditional and modern soups coexist, catering to a wide range of tastes.