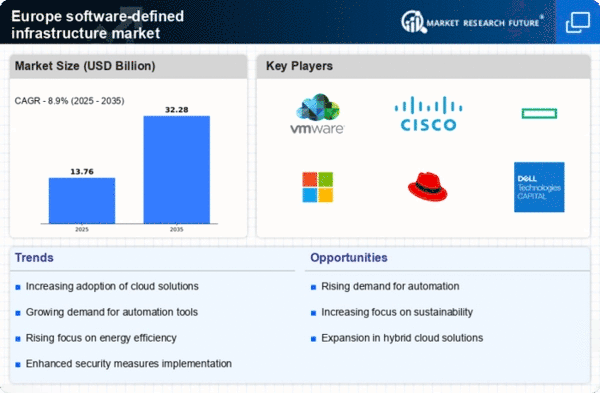

Rising Demand for Scalability

The software defined-infrastructure market in Europe experiences a notable surge in demand for scalable solutions. Organizations are increasingly seeking infrastructure that can adapt to fluctuating workloads and business needs. This trend is driven by the necessity for flexibility in resource allocation, enabling companies to optimize their operational efficiency. According to recent data, the European market for scalable infrastructure solutions is projected to grow at a CAGR of 15% over the next five years. This growth is indicative of a broader shift towards dynamic resource management, where businesses can scale their infrastructure up or down based on real-time requirements. As a result, the software defined-infrastructure market is likely to witness significant investments aimed at enhancing scalability features, thereby attracting a diverse range of enterprises looking to modernize their IT environments.

Shift Towards Hybrid Cloud Models

The software defined-infrastructure market in Europe is experiencing a significant shift towards hybrid cloud models. Organizations are increasingly adopting hybrid solutions that combine on-premises infrastructure with public and private cloud services. This trend is driven by the need for flexibility, security, and cost-effectiveness. According to market analysis, approximately 60% of European enterprises are expected to implement hybrid cloud strategies by 2026. This shift allows businesses to leverage the benefits of both cloud and on-premises resources, optimizing their IT investments. The software defined-infrastructure market is thus adapting to this demand by offering solutions that facilitate seamless integration and management of hybrid environments, ensuring that organizations can efficiently navigate their digital transformation journeys.

Growing Emphasis on Sustainability

The software defined-infrastructure market in Europe is increasingly influenced by a growing emphasis on sustainability. Organizations are recognizing the importance of adopting environmentally friendly practices, leading to a demand for energy-efficient infrastructure solutions. This trend is driven by regulatory pressures and consumer expectations for sustainable operations. Recent data indicates that investments in green IT initiatives within the software defined-infrastructure market are projected to increase by 25% over the next three years. As a result, vendors are focusing on developing solutions that minimize energy consumption and reduce carbon footprints, aligning with the broader goals of sustainability and corporate responsibility. This shift not only benefits the environment but also enhances the reputation of organizations committed to sustainable practices.

Focus on Enhanced Security Measures

As cyber threats continue to evolve, the software defined-infrastructure market in Europe is witnessing a heightened focus on enhanced security measures. Organizations are increasingly prioritizing the protection of their digital assets, leading to a demand for infrastructure solutions that incorporate robust security features. Recent reports suggest that security-related investments in the software defined-infrastructure market could reach €10 billion by 2027. This trend is indicative of a broader recognition of the importance of cybersecurity in maintaining operational integrity and customer trust. Consequently, vendors are developing solutions that integrate advanced security protocols, threat detection, and response capabilities, ensuring that organizations can safeguard their infrastructure against potential vulnerabilities.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) technologies into the software defined-infrastructure market in Europe is becoming increasingly prevalent. AI-driven solutions facilitate enhanced automation, predictive analytics, and improved decision-making processes. This integration allows organizations to optimize their infrastructure management, leading to reduced operational costs and increased efficiency. Recent studies indicate that AI adoption in infrastructure management could lead to cost savings of up to 20% for European enterprises. Furthermore, the software defined-infrastructure market is witnessing a growing interest in AI-powered tools that can analyze vast amounts of data to predict infrastructure needs and automate routine tasks. This trend not only streamlines operations but also empowers organizations to focus on strategic initiatives, thereby enhancing their competitive edge in the market.